Is Dogecoin A Hedge Against Inflation?

THIS Is Why Dogecoin

Hey everyone,

No topic sparks online financial debate like inflation.

Inflation has defined this decade’s economy, dominating headlines in 2020, 2021, and 2022. Last year, the it cooled off, but in 2024 it’s back again with a vengeance.

Let’s take a look at why inflation is suddenly a hot topic again, and how Dogecoin stacks up against other currencies as an inflation hedge.

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

After a year under the radar, inflation is suddenly a hot topic again on 𝕏.

Back in 2021, in a controversial post, Twitter founder Jack Dorsey predicted hyperinflation for the US dollar.

At the time, dollar inflation was just kicking into gear as a delayed response to all the new money created during 2020.

Ever since Dorsey’s post, the big debate on financial social media has been whether inflation will turn out to be temporary, or if we’re living through the early stages of a grand inflationary reshaping of the global financial order.

For most of 2021 and 2022, dollar inflation was a big deal.

Prices of housing, food, and energy soared as the dollar lost value.

Eventually, it provoked the Federal Reserve to raise interest rates at a historic pace.

Last year, it started to look like the Fed’s interest rate hikes had gotten inflation under control. Goods and services were still getting more expensive, but the rate of increase was slowing down.

As inflation approached the Fed’s 2% target, some folks even declared mission accomplished for corralling inflation.

However, in 2024 signs are popping up that the narrative around inflation is changing once more.

Higher-than-expected inflation measurements this year suggest that inflation may be coming back with a vengeance.

Despite the early warning signs, the political establishment is still telling the public not to worry about inflation.

Last Thursday, President Biden took to 𝕏 to assure the public that “inflation is the lowest it has been in three years.”

Inflation is a massive political liability for whomever is in power because it functions as a tax that disproportionately impacts the middle and lower classes. With prices at historic highs, not everyone is buying the optimistic outlook.

Right now, the biggest evidence inflation is returning comes from the Fed.

At the end of 2023, the Central Bank predicted six interest rate cuts in December.

Now, it looks more likely the fed will cut rates three times at most.

The possibility of rate hikes is even being discussed, which would amount to an admission of defeat by the Fed.

Another intriguing data point is Bitcoin.

The most-common explanation for Bitcoin’s recent surge is that investment banks are buying ETFs.

But another possibility is that savvy investors are accumulating Bitcoin now in anticipation of future inflation, as they did in 2020 when the Fed increased the money supply by 40%.

In a recent newsletter titled “Bitcoin Is Sounding The Alarm On Inflation”, Pomp proposed that the real story is that ETFs have increased access to Bitcoin as an inflation hedge:

“the risk of inflation coming back is getting higher each day. Some investors are buying bitcoin in anticipation of that situation coming to fruition. The new investment vehicle presented via ETFs gives more capital the option to use this asset than at any other time in history.”

Bitcoin’s absolute 21M-coin scarcity theoretically makes it the ideal hedge against inflation.

By contrast, government fiat money is routinely conjured into existence out of thin air with a few keystrokes.

There’s no cap on the number of fiat dollars that can be created, meaning there’s no limit to how much the dollar can be devalued.

If Bitcoin is the ideal inflation hedge, and fiat is perpetually vulnerable to inflation, Dogecoin operates somewhere in between the two.

Dogecoin is inflationary, but its inflation works differently than fiat.

The reason is that Doge is issued on a fixed schedule, so you know exactly how many coins will exist at any point in time, whether it’s next month or in 100 years.

If Bitcoin is deflationary and fiat is unpredictably inflationary, Dogecoin sits perfectly in the middle as predictably inflationary.

As the saying goes, Dogecoin’s inflation is a feature, not a bug.

It turns out that just a little bit of inflation can actually be a good thing. Dogecoin’s programatic inflation actually serves three purposes:

Inflation encourages spending over hoarding, boosting Doge’s use case as a Medium of Exchange

Newly created coins balance out coins that have been lost

Creation of new coins incentivizes Dogecoin miners to keep running, which improves network security

As Elon argued in 2021, Dogecoin is inflationary, but “not meaningfully so,” while Bitcoin is “deflationary to a fault.”

When it comes to inflation, Dogecoin is closer to Bitcoin than it is to the dollar.

Doge’s rate of inflation programmatically decreases each year, trending toward zero but never actually reaching it.

It’s impossible for Dogecoin to have a year like the dollar did in 2021, where inflation unpredictably spiked.

With Doge, there can be no Argentina- or Zimbabwe-style currency collapse where government devalues its by endless printing to honor its debts, destroying its citizens’ wealth in the process.

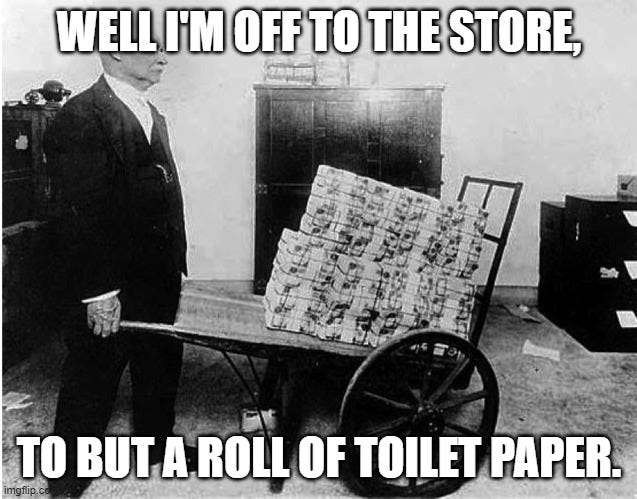

In comparison to both Bitcoin and Dogecoin, dollar inflation is arbitrary and unpredictable.

Whenever politicians and bankers decide to turn on their printers, money supply can increase by leaps and bounds.

The story of the Federal Reserve—in which control over money was transferred from the US Treasury to the international banking cartel—is not coincidentally also the story of the dollar’s destruction.

Today, people take for granted price increases are inevitable, but nothing could be further from the truth.

In a healthy economy, goods and services cost less over time because improvements in technology allow people to deliver them more efficiently.

As last week’s newsletter argued, Bitcoin’s main utility is as a store of value—a place to keep your wealth where it won’t be eroded by inflation.

At the same time, Bitcoin is fading a Medium of Exchange. No one spends Bitcoin because it’s been too succesful as an SoV.

If you want a currency that you can spend but is also is guarded from the worst excesses of inflation, Dogecoin is the way.

The main drawback to treating Dogecoin as an inflation hedge is its volatility.

Doge is theoretically set up to protect its holders against dollar inflation, but for now it is still a speculative asset, which comes with dramatic day-to-day price swings.

Built into the “doge-to-a-dollar” meme is the idea that, at some point in the future, its dollar price will level off, making it easier to use as a transactional currency.

When no one can predict the number dollars that’ll be printed next month, there’s something powerful in being able to know exactly how many Dogecoins will exist in 100 years.

Among the world’s currencies, Doge’s pre-determined issuance positions it to outcompete all fiat currencies as an inflation hedge.

Dogecoin isn’t an inflation hedge yet, but some day we might be talking about how Dogeflation solved inflation for good.

Dogey Treats: News Bites

Dogecoin core developers released their 1.14.7 update. The update contains security improvements and enhancement to fee estimation. Doge dev Timothy Stebbing gave a sneak peak of the Dogecoin Foundation’s updated trail map.

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? What was the biggest development for Doge this week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.17 per coin.