Dogecoin Completes Bitcoin

THIS Is Why Bitcoiners Will Inevitably Adopt Doge For Transactions

Hey everyone,

Bitcoin has been on an absolute tear this year.

What’s amazing is that it’s experiencing incredible growth even though no one is using it to buy things.

Last week, several prominent Bitcoiners came out and spoke a forbidden truth: Bitcoin is a great investment, but it’s failing as digital cash for everyday purchases.

Let’s take a look at why Bitcoin doesn’t work as a transactional currency, and how that opens the door for Doge.

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

Bitcoin is having an incredible year, and its awesome rise has brought back positive crypto vibes to 𝕏.

But surprisingly, its success has come even though no one is using it to buy things.

This month, several influential Bitcoiners acknowledged a harsh reality: people aren’t using Bitcoin as a transactional currency.

To understand what’s really going on, it helps to know the three purposes of money.

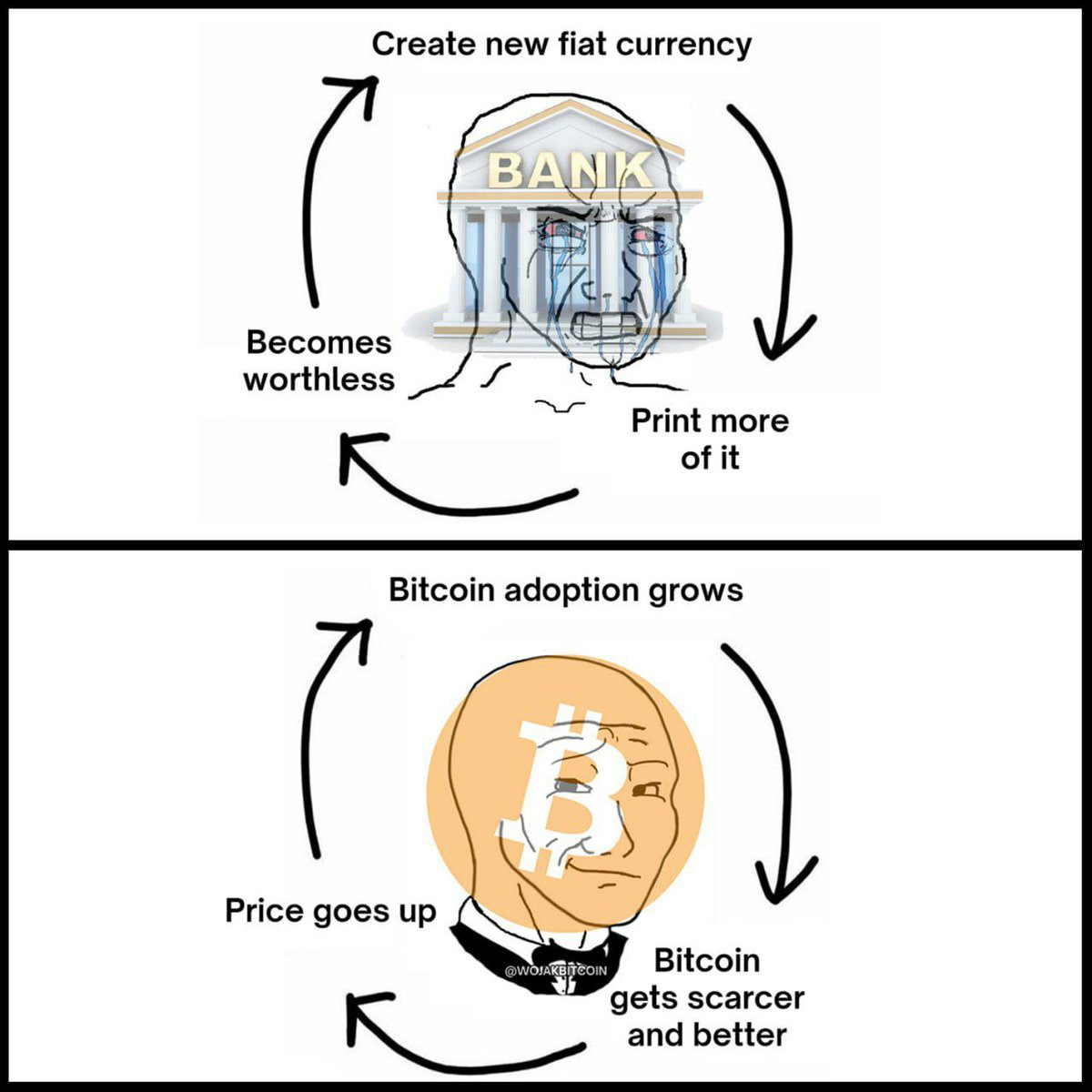

Most people typically think of money as one thing, but it actually has three distinct functions: medium of exchange, store of value, and unit of account.

Bitcoin has enjoyed tremendous success as a store of value—a safe place to store wealth and offset inflation.

Bitcoin’s success as a SoV is what led financial giants like BlackRock and Fidelity to launch Bitcoin ETFs earlier this year.

If you’re worried that governments are going to keep printing money and inflation will get worse over the long haul, Bitcoin is historically a safe place to store your wealth.

This is true despite its day-to-day price volatility—for fifteen years, Bitcoin has outperformed every form of government money on the planet as a tool to preserve wealth.

The same thing that makes Bitcoin a great Store of Value makes it a bad Medium of Exchange for small everyday purchases.

Bitcoin is an amazing investment because its supply is limited.

Unlike government fiat money which can be created endlessly, the number of Bitcoins is forever fixed at 21 million.

This hard-coded scarcity is the driver of its incredible price appreciation.

The problem arising now is that enough people have figured out that the best strategy with Bitcoin is just to hold on to it for as long as possible.

Spending Bitcoin is the same as selling it. Everyone knows the story of the guy who bought two pizzas for 10k Bitcoins, now worth hundreds of millions of dollars.

There’s no reason to ever spend Bitcoin if you think it’ll be worth more in the future and can afford to use another, more inflationary currency for purchases.

Rather than use Bitcoin for transactions, people are turning to stablecoins—digital versions of fiat currencies—when they want to buy and sell with digital cash.

Last week, prominent Bitcoiner Nic Carter coined the term Orange Man’s Burden. The term describes hardcore Bitcoiners’ stubborn belief that developing countries will adopt Bitcoin as money despite clear evidence that regular folk prefer to transact with stablecoins.

Carter’s word carries weight in crypto circles, and he has identified an important trend: Bitcoin is already losing to stablecoins as a Medium of Exchange.

Carter was reposting comments from Russell Okung, a former NFL player who’s advocated Bitcoin adoption in Africa.

A day earlier, Okung acknowledged that most African citizens would rather use stablecoins like a digital dollar than Bitcoin as a Medium of Exchange.

Okung came to this conclusion against his own will, based on first-hand experience trying to advance Bitcoin as a transactional currency in Africa.

Another influential Bitcoiner, Anthony “Pomp” Pompliano, summarized the growing recognition that Bitcoin has fallen short as a transactional currency in an article titled “Bitcoin Is Not A Popular Medium-Of-Exchange.”

In the article, Pomp wrote that Bitcoin is capable of being used as a spendable currency, but most people would rather save n Bitcoin and spend digital dollars: “The limitations for bitcoin as a medium-of-exchange are not technical, but rather a game theory that highlights bitcoin’s future success in price could be its worst enemy as a spendable currency.”

Pomp’s article marks a noteworthy change of opinion.

In 2021, he argued that the “holy grail” of money would serve as both a store of value and medium of exchange—a savings and spending technology in one.

Back then, he felt that Bitcoin fit the bill better than anything else, including Dogecoin, and didn’t foresee a role for dog money in the digital economy.

It’s promising that major Bitcoiners like Pomp, Carter, and Okung are recognizing Bitcoin probably won’t be adopted as a Medium of Exchange. But their suggested replacement of stablecoins is an odd choice.

Stablecoins are convenient form of digital cash, but they lack Bitcoin’s superpower: decentralization.

Anyone on the planet can run a Bitcoin node, and there are no special levers in Bitcoin that allow someone to use it as an instrument of censorship, financial surveillance, or inflation.

By contrast, the two biggest stablecoins are Tether (USDT) and US Dollar Coin (USDC).

Both are managed by private corporations. These corporations issue digital tokens, and back them with real dollars, treasury bills, and other assets.

The downside of stablecoins is that the issuing corporations have unmatched control over them.

The core ethos of Bitcoin is that regular people own and control money, and can influence its direction democratically.

Stablecoins replicate many of the worst features of the existing system by handing special powers to a few centralized and unaccountable corporations that are themselves susceptible to government pressure.

If the US government tells stablecoin issuers like Tether or Circle to confiscate people’s money, there’s no guarantee the companies won’t give in.

At their worst, stablecoins could become a sort of CBDC-lite, with a government-corporate hybrid exercising unprecedented control over money, just as government-big tech has done with speech.

Dogecoin is a a better digital Medium of Exchange than stablecoins because it is decentralized like Bitcoin.

No single entity owns the Dogecoin blockchain, so it can’t be censored or centrally controlled.

Doge’s code is nearly identical to Bitcoin’s, but its slightly inflationary issuance schedule, fast transaction times, and low fees encourage spending rather than saving.

In short, Dogecoin is like Bitcoin, but branded with a dog and optimized for spending.

Ideally, Bitcoiners would embrace Doge as a friendly complement to orange coin.

Dogecoin’s much wow meme virality makes it the perfect vehicle for onboarding regular folks into crypto.

Once people have a chance to play around with digital money in a low-stakes way, they’re more likely to allocate some portion of their wealth to Bitcoin. What’s good for Dogecoin is ultimately good for Bitcoin as well.

In the past, Carter, Pomp, and Okung have all taken a dim view of Doge.

In 2021, Carter called Dogecoin “an empty husk” and warned that Elon’s support would cause retail investors to lose money.

After Elon embraced Doge, Okung ran a billboard campaign urging him to stay out of crypto.

On his news show, Pomp was similarly reluctant to praise Dogecoin as a crypto with real-world utility.

The truth is that there is something of an unspoken fiat within the Bitcoin community against talking about Doge.

Since 2021, Bitcoiners have seen Dogecoin as a threat to their vision of Bitcoin becoming the global Medium of Exchange, turning what should be a friendly partnership into a turf war.

History seems to have taken a different path than the Bitcoiners imagined, though. Bitcoin is the most succesful cryptocurrency, and by several metrics adoption has never been greater, but no one wants to spend it, least of all Bitcoiners themselves.

The growing acknowledgment that Bitcoin has fallen short as a MoE is an intermediary step to recognizing that Dogecoin is the ultimate digital currency for transactions.

Prominent Bitcoiners like Pomp, Carter, and Okung have a golden opportunity to throw their support behind Dogecoin, which captures the original Bitcoin vibe of decentralization, financial revolution, and memetic flare.

As Pomp wrote, “only independent thinkers will be able to change their mind when presented with these new facts. Don’t fall into the rigidity of the bitcoin religion imposed by the loudest hardcore maximalist.”

The ideal Internet economy has room enough for two complementary decentralized forms of money: Bitcoin for saving and Dogecoin for spending.

A harmonious collaboration between the two communities would strike fear into the heart of the financial establishment and accelerate the world’s transition to sound digital money.

The beauty of Dogecoin’s playful-spirit is that whenever Bitcoiners finally decide to drop their vendetta against it, they will be welcomed into the Dogely fold with open arms.

Bitcoiners laying down their swords and joining the fun-loving DogeArmy is the most entertaining outcome for crypto, finance, and the Internet as a whole.

It might even be inevitable. Let’s see what happens…

What do you think: Is Dogecoin the perfect complement to Bitcoin? Will Bitcoiners come around?

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? What was the biggest development for Doge this week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.08 per coin.