THIS Could Be The Biggest Financial Story Of The Year

Everything you need to know about the debt ceiling

Last month, the US government bumped up against its debt ceiling.

The government owes nearly $32 trillion dollars. The Treasury is currently resorting to “extraordinary measures” to pay its bills, and expects to run out of cash this summer unless Congress agrees to raise the borrowing limit.

In years past, battles over the debt ceiling have made for entertaining political theater, but there was little doubt in the end both parties would find a way to keep the money flowing.

This time could be different. The coming showdown is shaping up to be one of the biggest stories of the year, with far-reaching consequences for the global financial system.

Here’s everything you need to know about the debt ceiling, including what it could mean for Dogecoin.

The debt ceiling has been a bone of contention between Democrats and Republicans for years.

The parties clashed about raising the debt ceiling 2011 and again in 2013, with Democrats favoring raising the borrowing limit and Republicans calling for cuts to government spending.

Both fights were bruising. The 2011 battle caused the stock market to experience its most volatile week since 2008 and led to a downgrade in the US’s credit rating. 2013’s showdown resulted in a partial government shutdown.

So far this year, the main actors in the debt ceiling negotiation have been Treasury Secretary Janet Yellen and Republican House Speaker Kevin McCarthy.

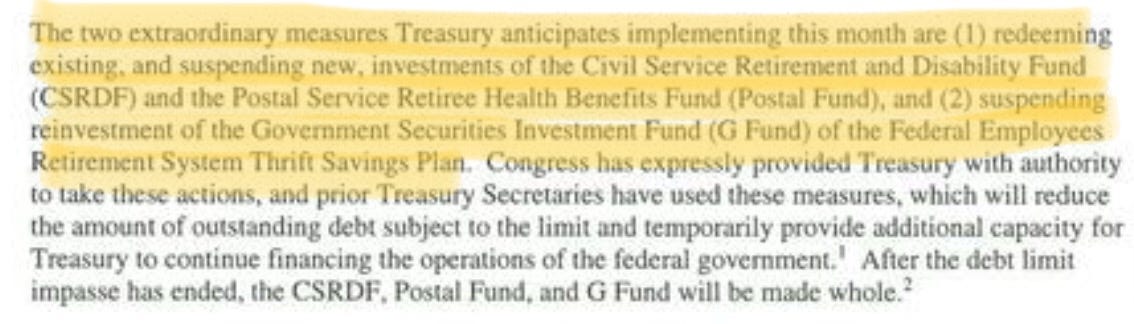

In January, Yellen sent a letter to McCarthy warning that the US would hit its debt limit within a week, forcing the Treasury to “start taking certain extraordinary measures to prevent the US from defaulting on its obligations.”

The letter went on to explain that the Treasury would begin using investments from the Civil Service and Postal Service retirement funds to meet its obligations. The Treasury may also use 2023 corporate tax payments and its existing cash balance.

At the end of the letter, Yellen said emergency measures would be exhausted by June. She cautioned, “Failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans, and global financial stability.”

McCarthy has framed the debt in terms of America’s future. After meeting with Joe Biden this week, he told reporters, “I’m here to make sure [parents’] children do not continue this debt […] The greatest threat to America is our debt. Our debt is now at 120% of GDP, meaning our debt is larger than our economy.”

In hindsight, past battles over the debt ceiling look an awful lot like political theater.

The showdowns allowed conservatives to pose boldly on the ramparts of fiscal restraint while continuing business as usual, especially when it came to defense spending.

Last week, White House spokesperson Karine Jean-Pierre implied her administration was calling the GOP’s bluff when she told reporters, "This should be done without conditions […] There’s going to be no negotiation over it."

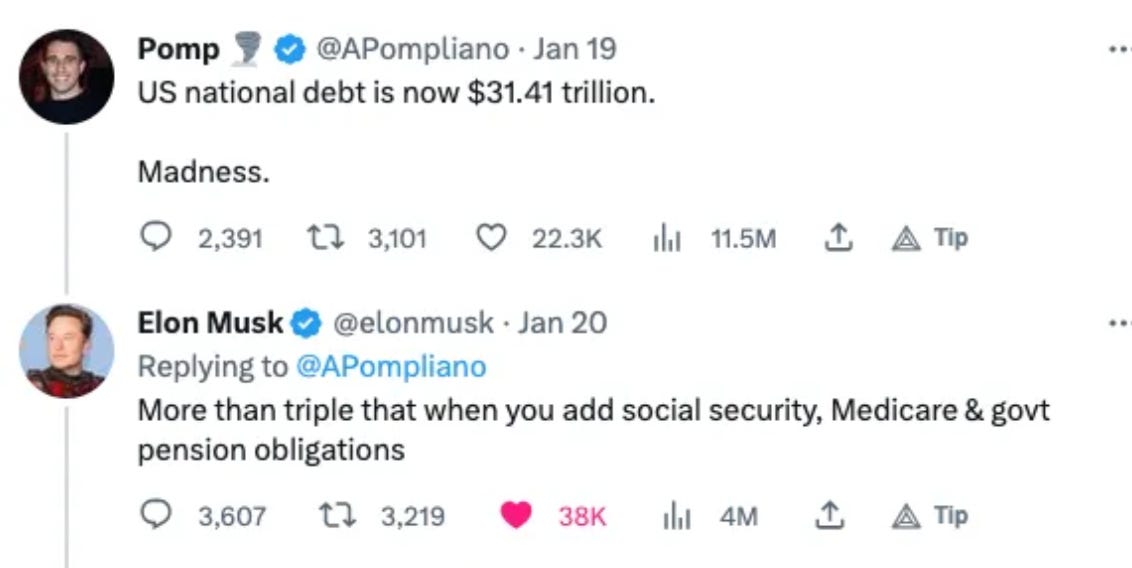

Whether the negotiations are real or merely theatrical, the enormity of the debt has caught Elon’s notice.

Last week, he posted a meme making light of the government’s spending problem.

The meme is powerful because it captures a complex issue in personal terms that everyone can understand.

It does seem strange how the financial system ruthlessly punishes individuals for mismanaging money, yet the government is able to pass the consequences of its own fiscal irresponsibility onto future generations of Americans.

The topic of government spending has been on Elon’s radar for a while. Last February, he responded to a satirical article from The Babylon Bee by arguing that the real debt is greater than the official number, writing, “Something has got to give.”

A few weeks ago, he reiterated his stance, this time arguing that the national debt should be calculated at closer to $100 trillion when entitlement spending is factored in.

Elon’s claim that pension obligations are part of the debt deserves attention, given that the government started recently using pension fund investments to meet its current financial demands.

From this perspective, it looks an awful lot like the government is borrowing from one pot of money it has promised to former employees to fill another, making the Treasury resemble a struggling ponzi scheme.

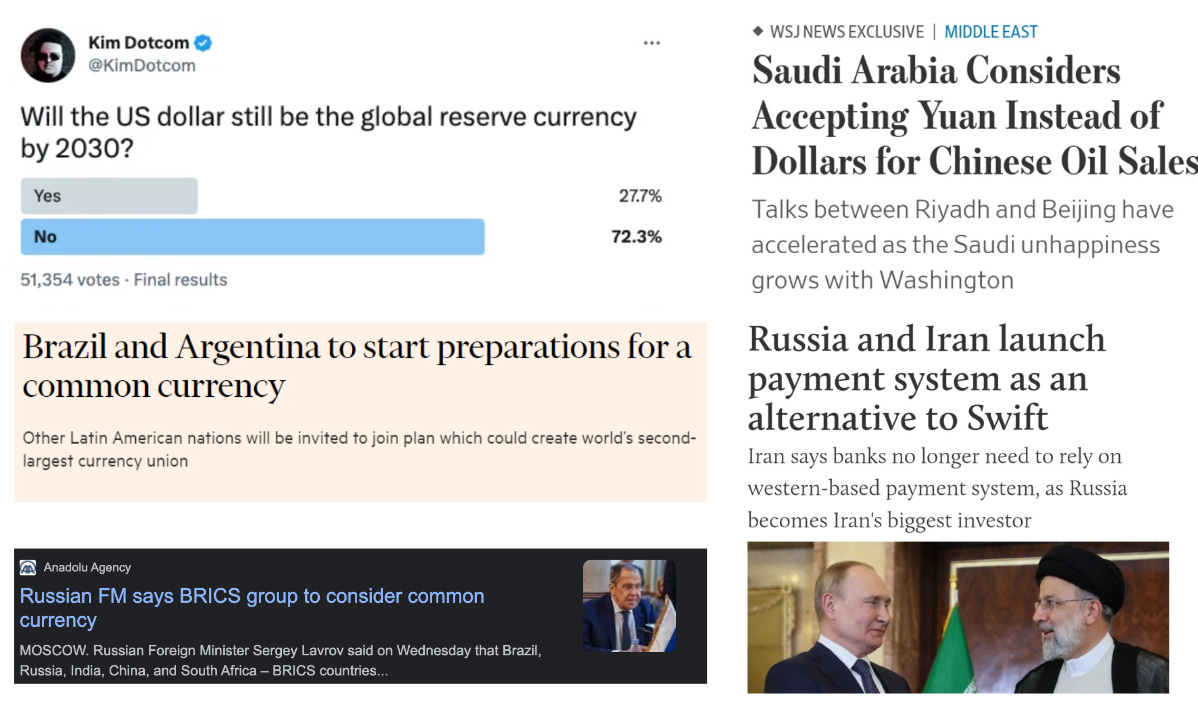

How much longer the government can kick the can down the road is an open question. A number of factors could make this year’s debt ceiling negotiation more consequential and dramatic than those in 2011 and 2013.

We are experiencing record high inflation due to a historic program of money printing to prop up the global economy during the pandemic

The Federal Reserve kept interest rates low throughout the 2010s, but in an effort to tame inflation, the Fed has been raising rates since last year; this makes interest payments on the national debt more expensive

As fallout from 2022’s financial sanctions against Russia, a number of countries are openly contemplating forming alternate economic unions; the dollar is at greater risk of losing its status of global reserve currency than at any point in five decades

There is one more wild-card factor that makes this year’s showdown spicier than 2011 or 2013.

🚨 The rest of this article is for paid subscribers of It's ALL Risky. Your support helps us to provide a free newsletter every Monday, as well as bonus articles like this one. All proceeds go tow improving this newsletter. Subscribe below, and thank you for your continued support.🚨

Keep reading with a 7-day free trial

Subscribe to Risky Reads to keep reading this post and get 7 days of free access to the full post archives.