The Great Crypto Psyop

Why Doge is the Real Deal in a Crowd of Phonies

Hey everyone,

The idea of a psyop, or psychological influence operation, has become powerful meme in recent years.

The Internet is rife with artificiality, and the psyop meme invites useful questions about who is trying to influence public opinion, and why.

This is nowhere more the case than in the world of crypto. It’s worth examining at the entire crypto space as if it were a giant psychological operation.

When put under the microscope, the crypto psyop turns out to be a multi-layered phenomenon, involving economic, psychological, and memetic elements. Let’s go deep into the crypto psyop, and look why Dogecoin is its antidote.

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

0. What Is A Psyop?

A psychological operation, or psyop, is an organized attempt to influence the thinking and behavior of a group of people.

The term psyop has military origin, but in recent years has expanded to encompass propaganda operations by private actors, including corporations, NGOs, and individuals.

Social media is filled with psyops.

Some are benign, like astroturfed ad campaigns designed to create an artificial sense of virality over a product.

Others are more malicious, and suggest state-level actors looking to sow chaos among a population.

In general, social media psyops involve some combination of bot armies and algorithmic manipulation to control the perceived popularity of a given idea.

Since taking over Twitter, Elon has been vocal about identifying psyops taking place on his platform.

The Twitter Files is the best example of Elon dismantling a government psyop: it revealed how intelligence agencies embedded in social media companies to promote certain political ideas and censor others, with the broad goal of manipulating public opinion.

As he has worked to expose psyops, Elon has become increasingly active in political discussions on 𝕏.

One way to interpret his online behavior is that he deliberately targets topics where the public has been propagandized, and uses his personal platform to highlight evidence that undermines the propaganda narrative.

Sometimes he does this by engaging opinions:

Other times he points out data that runs contrary to a false narrative:

But probably the most effective counter-propaganda on a pound-for-pound basis is memes.

Psyops make great material for memes, because memes can puncture the veneer of a influence operation through humor and irony:

Cryptocurrency is perhaps the most fascinating psyop on the Internet.

It involves a combination of an economic pitch about a powerful new technology, a sophisticated propaganda playbook, and a memetic element.

Unfortunately, the goal of most crypto projects is to convince people into giving away their money.

The psyop appears to be run by mysterious, globally connected, and deep-pocketed actors.

It’s anyone’s guess how deep the crypto psyop goes. This is an attempt to drag it into the light.

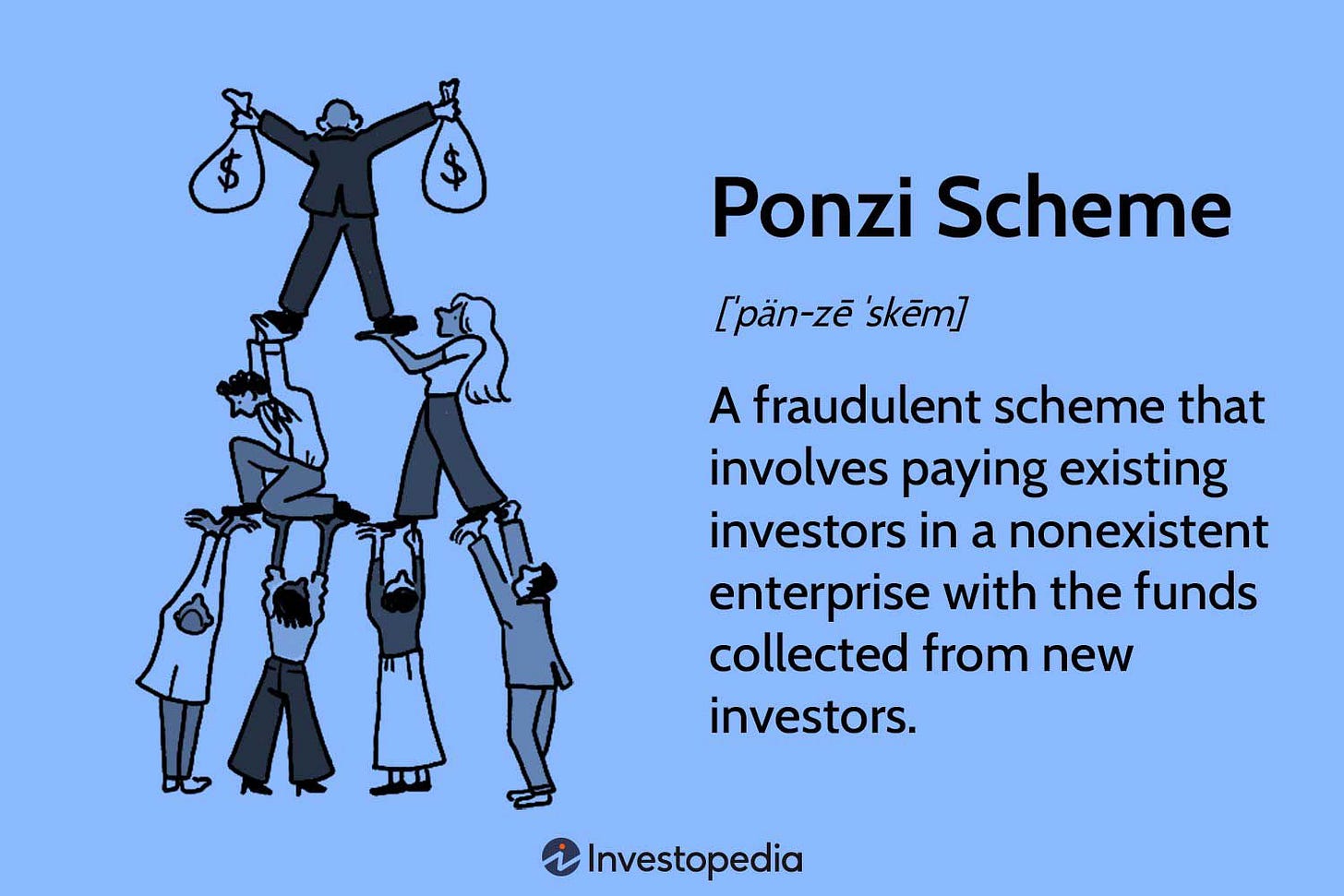

I. Ponzi-nomics

The first layer of the crypto psyop is economic: it offers the promise of making money.

The vast majority of cryptocurrencies follow a Ponzi scheme playbook perfected long before crypto came into existence.

At the top level of the Ponzi pyramid sit a handful of insiders who participate in the creation of the digital tokens, which can be made in a matter of minutes at next-to-no cost.

The creators’ goal is to convince other people to exchange real money for crypto tokens, which are often intrinsically worthless.

They do this by running flashy social media ad campaigns to promote their new coin.

These campaigns enlist influencers and exchanges, who occupy the middle rung of the Ponzi.

Influencers vary from anonymous social media accounts to big name celebs like Kim Kardashian and Steph Curry. Oftentimes, smaller influencers will accept a bag of newly minted tokens in exchange for promoting the project in their posts.

Exchanges are the nexus for these crypto transactions to take place. They make money on transaction fees from selling crypto tokens to retail investors.

Like influencers, exchanges benefit from keeping up an appearance of reputability and trustworthiness, but in the end they’re in the same game of convincing retail investors to swap real money for ephemeral tokens.

Retail investors occupy bottom rung of the ponzi pyramid.

By the time retail buys into a project, it has already been passed from creators to middlemen like exchanges and influencers.

For a retail investor to make money, another, later arriving retail investor must come along and be willing to pay more. This is sometimes known as the greater fool theory.

Though the odds are stacked against retail investors, it is possible to make money investing in crypto.

Some projects turn out to be more useful than anyone expected, and actually grow in value over time.

Bitcoin is the best example: it functions as a digital of store of value, like a bar of gold that can be instantly sent anywhere in the world over the Internet.

When Bitcoin was first created, people didn’t realize it would be so useful, but over time, the market has decided its innovations are worth several hundred billion dollars.

However, Bitcoin is the exception. The majority of cryptocurrencies hit a price peak during an early speculative frenzy when they’re being sold to retail. Creators, influencers, exchanges, and maybe a few early investors cash out, while the little guy is left with a bag of tokens.

II. Anatomy of the Crypto Psyop

Ponzi-nomics is not unique to cryptocurrency.

Legacy finance is rife with opportunistic middlemen looking to line their pockets by skimming value from regular people.

But the crypto psyop goes deeper. There are psychological, algorithmic, and even artificially intelligent aspects overlaid on top of crypto ponzis that make the psyop uniquely complex:

Only the young: Younger generations are the main target of the crypto psyop.

Crypto is popular among young people because it combines technological optimism with the possibility of personal enrichment.

Younger folks are attracted to this vision because it plays into their own experience: the last two decades have witnessed an extraordinary technological revolution, with the Internet disrupting one industry after another.

Despite advances in information technology, banking—maybe the most lucrative business in the world—still uses systems developed in the 70s. It appears primed primed for disruption.

Crypto offers the promise to upgrade money and initiate a historic transfer of wealth. Younger folks, not surprisingly, are drawn to that vision because it offers personal hope and a vision for a better future.

Influencer-industrial complex: As social media has moved in on legacy media’s territory, traditional celebrities are being replaced by online influencers.

The key metric that distinguishes influencers from everyone else is high-follower counts, with serve as a shorthand for success and importance.

Crypto influencers are often flanked by artificially intelligent bot swarms that make it appear as if they riding herd on a large community of likeminded investors, giving them credibility they’d otherwise lack.

Manipulated markets: Crypto is known for its dramatic price swings.

Most cryptocurrencies track Bitcoin. When it goes up, others follow. When it goes down, they go down too.

Bitcoiners like to insist that Bitcoin’s price closely hews to the laws of supply and demand, and can’t be gamed. But in 2021, Elon hinted that its price can in fact be manipulated.

The reality is that the price of Bitcoin—and by extension all other cryptocurrencies—is likely gamed to turn the market into an emotional rollercoaster.

This artificially induced volatility often pairs with poorly timed advice from influencers, who’ve been caught repeatedly shilling their own bags at the market top.

Speculative Frenzy: One of the more insidious aspects of cryptocurrency psyop is that it promotes the idea that it’s possible to get rich without creating anything of real value.

When crypto markets are pumping, it seems like there’s free money everywhere. Retail investors rush in with the hopes of quick enrichment.

Media coverage tends to emphasize the speculative frenzy of crypto, while ignoring the hard work being done by the industry’s builders—entrepreneurs and developers working to use blockchain to upgrade banking.

Beneath the speculation, a handful of crypto projects promote a noble mission of financial inclusion, non-governmental money, and technological advancement

As long as crypto is presented as an online casino, though, the public risks missing the real revolution.

The dark side of memes: Memes are the best part of social media. They combine humor, information, and even wisdom into a cutting-edge digital art form.

Ever since Dogecoin took off in 2021, a parade of meme coins—cryptocurrencies based on memes—has followed in its wake.

Meme coins seek to replicate Doge’s formula, tying a crypto ad campaign to the virality of a popular meme.

Unfortunately, the vast majority of these derivative meme coins—maybe even all of them—are designed to pump and dump, enriching their creators at the expense of retail.

The meme coin industry is the crypto psyop on steroids, harnessing the dark side of memes to rope more people into the ponzi.

III. Who Runs the Crypto Casino?

A good test to tell if something is a psyop is if it has the appearance of grassroots support, but lacks a convincing origin story to account for how that support developed.

Crypto is a great example: most cryptocurrencies emerge from thin air as the work of anonymous creators. Thousands of followers and millions of dollars materialize overnight to prop up the latest coin-of-the-moment.

Over time, crypto has grown to become a big-money operation: its current market cap is $1.7 trillion and has reached as high as $3 trillion. Whoever is behind all these projects has access to vast financial resources.

Given the amount of money involved, it’s reasonable to who really runs the crypto game?

Recently, the digital artist Beeple has taken on this subject in his “Everydays” series, suggesting that an elite cabal of financial insiders controls crypto markets.

Beeple’s art is suggestive but vague. For the most part, he doesn’t name names.

During crypto's 15 years of existence, a rotating cast of scam artists, fraudsters, and other shady figures has populated its upper echelons. A handful of bad actors have even been caught breaking the law.

But whenever they're brought to justice, it’s usually done in a contained way, with no collateral damage to the world outside of crypto.

From time to time, a big name from the legacy world pops up in connection with crypto fraud, but the details are usually sparse. It’s hard to tell who’s pulling the strings, and whose just hanging around to make a buck.

Whoever runs the crypto casino, they are sophisticated, wealthy, and armed with some of the most advanced technology in existence.

Hopefully, in time, the true crypto mafiosos are unmasked.

IV. Dogecoin Is the Anti-Crypto

Dogecoin is the inverse of everything that is deceptive about the crypto psyop, starting with its creation.

In 2013 Dogecoin was made as joke to parody the speculative frenzy and artificiality of the crypto scene.

Dogecoin’s founders sold their coins early for minimal profit, meaning Doge doesn’t have the same ponzi-nomic scheme as other projects, with insiders dumping coins on later-arriving investors.

People first used Doge on Reddit for tipping because it was fun, not out of expectation of financial gain.

The fact that Dogecoin circulated freely early on, rather than being hoarded with the hope of riches, led to it being used to crowd-fund charitable causes.

Over time, Doge’s original use case as the “tipping crypto” developed into broader utility. The best argument for Dogecoin today is that it can serve as a form of fast, cheap digital cash for everyday transactions.

Ironically, Doge’s role as digital cash could make it the most useful cryptocurrency of all.

Dogecoin also distinguishes itself from other meme coins in that the Doge community is populated by real people who enjoy making memes and spreading the wholesomeness of Doge.

This spirit of creation pervades Dogecoin. People participate in the meme-powered community not out of passive expectation for wealth, but because they want to improve Doge’s infrastructure, strengthen its bonds, and build a better monetary future.

While other meme coins weaponize wholesomeness to make money for creators, the Doge meme is a genuinely positive force in the world.

Like the rest of the crypto market, it may well be the case that Doge’s price is being manipulated by mysterious big-money entities.

Since May 2021, there’ve been signs that that Doge has been suppressed by Wall Street suits.

Today, its clear that many from the establishment are still dead-set on preventing Dogecoin’s from succeeding as a digital dollar alternative.

But ironically, Doge’s US-dollar price doesn’t matter much as long as people treat Dogecoin as real money.

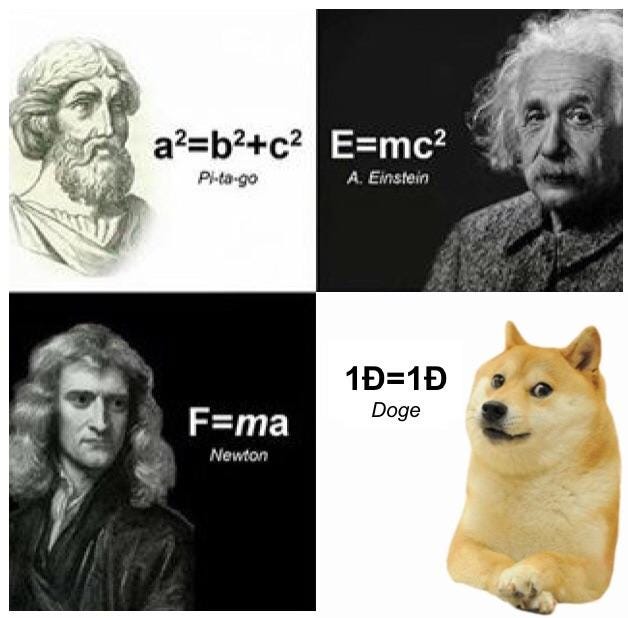

While others obsess over the market’s ups and downs, the long-standing meme in the Dogecoin community is “1 Doge = 1 Doge.”

The goal of Dogecoin-as-money isn’t to dump bags onto later investors for more fiat dollars at a future date.

Rather, it’s to increase adoption of Doge as legal tender, so a fun, wholesome dollar alternative can thrive.

In short, the idea isn’t to sell Dogecoin, it’s to use it.

The crypto psyop described above does not apply to all projects. A minority of cryptocurrencies advance the noble ideals of financial inclusion and monetary revolution.

Moreover, it's possible that the next time crypto markets rise, many questionable projects will still increase in value over the short term.

But an unusually high level of deception is the norm within the crypto space. Given crypto’s history, it doesn’t hurt to approach it with a high index of suspicion.

Of the few projects that bring real value to the world, Dogecoin stands alone in that it runs counter to the entire crypto psyop.

Most scams present themselves as serious and professional, only to turn out to be fraudulent. Doge short-circuits this dynamic by presenting itself as a joke that couldn’t possibly be taken seriously, but actually gains traction as real money.

Maybe the universe has a sense of irony, and the currency making fun of crypto will turn out to be the real currency. Wouldn’t that be the most entertaining outcome of all?

News Bites

Doge was listed on a Indian exchange

Williamsburg Pizza in Brooklyn started accepting Dogecoin.

Ripple’s Brad Garlinghouse mentioned Dogecoin at a session of the WEF’s Davos meeting, saying he “doesn’t get it.”

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? What was the biggest development for Doge this week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.08 per coin.