The Fall of a Crypto Titan

THIS Is Why The Latest Crypto Gangland Hit Creates a Power Vacuum—Will The Dogefather Fill It?

Hey everyone,

This past week saw big news: CZ, founder of the world’s largest crypto exchange Binance, was found guilty of breaking international money laundering laws.

Far from an isolated incident, the charges against CZ and Binance are the latest in an escalating tit-for-tat proxy war between two competing financial syndicates.

Let’s take a look at the big shakeup in the crypto racket, and how Dogefather could fill the power vacuum left by CZ’s demise.

Thanks for reading The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

Are you hearing about Elon Musk a lot these days?

My 𝕏 subscribers and I are reading Walter Isaacson's new biography about Elon Musk to demystify the man behind the Mars mission.

Subscribe via my profile to join the Tribe!

The Fall of CZ

Another crypto giant has fallen.

In the biggest shakeup since the collapse of FTX last year, the world’s largest crypto exchange Binance and its CEO Changpeng “CZ” Zhao pled guilty in US court to criminal charges of breaking sanctions and money transmission laws.

Binance agreed to pay a $4.3 billion penalty, while CZ personally paid a $50M fine and agreed to step down from Binance for three years.

US authorities said Binance broke anti-money laundering and sanctions laws by failing to adequately vet its clients.

The lapse resulted in the exchange servicing clients from Hamas, al-Quaeda, ISIS, and other terrorist groups. The US faulted Binance for not reporting over 100,000 suspicious transactions.

Attorney General Merrick Garland said the exchange did this knowingly: “Binance employees knew and discussed that the company was serving thousands of users in sanctioned countries, and they knew that facilitating transactions between U.S. users and users in sanctioned countries would be in violation of U.S. law. But they did it anyway.”

CZ’s fall marks the end of an era in crypto history.

For the last half decade, Binance and FTX (founded by recently convicted felon Sam Bankman-Fried) ran the show as the dominant exchanges in the east and west.

Together, the two founders functioned as top dons of the crypto industry during a period of extreme growth in the late 2010s and early 2020s.

Each operated with the tacit approval of a political regime. CZ has weathered claims of being a Chinese government asset. Whether that’s true or not, it’s unlikely Binance could’ve reached its level of success without the imprimatur of the CCP.

It’s well documented that SBF funneled millions in stolen customer funds to both major US political parties. When his empire collapsed, he was working with high-level financial authorities, including SEC chair Gary Gensler, to craft regulation favorable to his own exchange.

While the evidence isn’t conclusive, it’s fair to ask if both CZ and SBF weren’t merely the public faces of larger financial syndicates backed by anonymous, politically connected interests in the global financial racket.

The relationship between the two kingpins took turn for the worse in the summer of 2022, when CZ questioned FTX’s bookkeeping practices in a Twitter post.

Around the same time, SBF reportedly told US regulators that CZ was a Chinese asset, and asked whether CZ would be able to travel to the US without being arrested.

CZ escalated the feud in November 2022, when he publicly announced he was selling his several-billion-dollar ownership of FTX’s native token FTT.

The announcement triggered a run on the exchange, which was unable to provide customers with their money. In retrospect, CZ’s sale of the tokens was the kill shot that brought down FTX by revealing its fraud to the public.

In this light, the US political establishment’s decision to take out Binance might be understood as a retaliation for CZ blowing up its crypto casino in FTX.

If so, it’s reasonable to ask if whatever Eastern financial syndicate backing Binance will attempt to extract retribution on the US.

Interestingly, both CZ and SBF tried to curry favor with the Dogefather.

In April 2022, SBF tweeted a proposal at Elon to build a blockchain version of Twitter integrated with Dogecoin.

He also tried to buy equity in Twitter as part of Elon’s acquisition, but Elon sniffed him out as a fraud.

CZ had slightly better luck: Binance was able to get in on Elon’s Twitter acquisition, providing $500M of funding to buy the site.

Binance also promoted Doge. In late 2021, Binance ran a giveaway for a Doge-themed Tesla and $50k worth of Dogecoin.

However, something went sour earlier this year when CZ conspicuously unfollowed Elon. Neither offered explanation.

The fall of CZ could signal a period of transition for crypto. In June, one commentator predicted that Binance would be unseated before Wall Street firms like BlackRock enter crypto.

The reason is that Binance’s removal clears the way for the big boys of finance—BlackRock, State Street, and other old-money banking interests—to move into crypto territory.

What they’re after are the transaction fees that would’ve otherwise gone to Binance if it were still the world’s top exchange. Transaction fees are one of the main ways that exchanges make money, and it’s unlikely Wall Street will go all in on crypto until it has its own goombahs in place to take its cut of retail transactions.

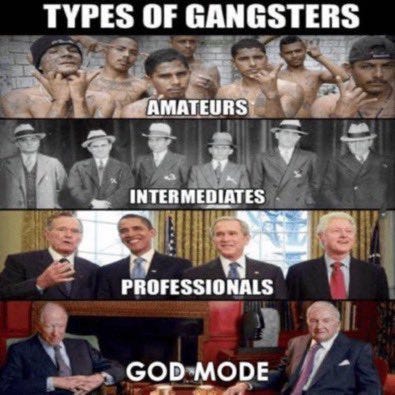

These various financial turf wars betoken a larger shift in the memescape: The Godfather is becoming the most relevant narrative for understanding the world today.

In the last week, Godfather mentions have starting to tick up on 𝕏, and for good reason: similar to how the declining Roman Empire captured the hive mind earlier this year, The Godfather is a useful metaphor for grasping the zeitgeist.

Under Elon, 𝕏 has transformed into a citizen-journalist machine for pulling back the curtain on shady dealings of the elites.

More than just finance, the business world itself is being revealed as a collection of competing cartels embroiled in an ongoing silent turf war: corporations, nation states, bloodlines, oligarchies, crime syndicates, and secret societies—all battling for resources and power in a global great game.

The name of the game is to prey on the 99%, and the only ethical constraint is what you can get away with without getting got.

This was always true, but now that the veil of censorship has been lifted from 𝕏, it’s becoming apparent how corruption and greed drive decision-making at the highest levels on a day-to-day basis.

The Godfather dramatizes the reality better than any other film, serving as a skeleton key for our current moment: it’s not just mobsters who operate in this ruthless cartel-land, it’s practically everyone with any significant power. Once you see it, you can’t unsee it.

The legacy press refuses to do its job and examine these realities, partly because it’s been captured by rapacious oligarchs, partly out of fear for the consequences that befall those who dare speak the truth.

As each day passes and more malfeasance is revealed on 𝕏, the corporate media’s failure to perform its most basic duties becomes harder to deny.

On the bright side, Elon’s purchase of 𝕏 instrumental giving the people a platform to speak this truth.

Given the failures of the old press, citizen and independent journalists have opportunity to expose the workings of shadowy elites. Elon’s use of his wealth to promote freedom is a glimmer of hope that regular folks have at least one ally in the oligarch class.

Of course, the idea of Dogecoin as “the people’s crypto” offers the possibility of a sovereign form of money that can’t be controlled by financial cartels.

That vision has yet to come to fruition. But while chaos plays out on the world stage, the Dogefather lurks in the shadows, watching his competitors take each other out, waiting for the perfect moment to make his move.

What do you think: Was CZ’s hit retribution by a Western financial syndicate?

Does his demise create a power vacuum in the crypto game? Who will attempt to fill it?

And when does the Dogefather strike?

Grok on Doge

With the full release of Grok to the public drawing near, we saw two more more examples of the world’s most exciting AI chatbot weighing in on Dogecoin this past week. Here they are:

Grok on the benefits of accepting Dogecoin for businesses

Grok on Dogecoin tipping on 𝕏:

Dogey Treats: News Bites

In 2021, a Netflix director used funds for a movie to gamble on markets. He lost millions in the stock market but made a killing on Dogecoin.

Billy Markus floated the ironic idea of Argentina adopting Dogecoin as legal tender.

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

Memes of the Week

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? When will the Dogefather strike? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.08 per coin.