The DogeArmy is Taking the Fight to Exchanges

Hey everyone,

Doge is meant to be spent.

The people’s crypto is designed to circulate quickly and cheaply, making it ideal for tips, donations, small purchases, and other transactions.

In 2021, Doge has been kenneled.

The main culprit has been crypto exchanges who have blocked Doge from being moved off their platforms.

The DogeArmy, with the help of the Dogefather, have been taking the fight to exchanges.

After a long battle, exchanges are showing signs that they’ll Release the Doge.

Here’s how it’s going down.

Retail is the Whale

Robinhood crypto wallets are closer than ever.

COO Christine Brown sent 420.69 Ð from Robinhood to an external wallet, first Dogecoin transaction of its WalletsAlpha program.

The transaction fee was half a cent.

Individual wallets will allow the DogeArmy to use their Robinhood Doge for transactions.

The DogeArmy has been lobbying Robinhood for more control over their coins for months.

Currently, all Dogecoin bought through Robinhood is still trapped on the platform.

Brown's transaction, which she posted to Twitter, was sent from a wallet that has a history of dealing with the DH5 GigaWhale.

Until recently, the GigaWhale was far and a way the largest Dogecoin wallet in existence, holding a third of supply—roughly ten billion dollars worth of Doge.

The size of the wallet led to some concern that a mysterious entity could tank the market by dumping its supply.

Now, the DogeArmy has confirmation that the GigaWhale is not one person, but represents thousands of Robinhood retail investors.

In late October, the DH5 GigaWhale was observed sending the majority of its Doge to smaller wallets.

As a result of this distribution, the DH5 wallet now holds 3% of all Doge.

The rest belongs to individual retail investors, many of whom have been diamond handing Doge for months.

Retail is the whale.

When wallets arrive, they'll finally be able to act like it.

Protector of the Doge

Binance is largest crypto exchange in world. Founded in China in 2017, it has quickly expanded across the globe.

Early this month, its CEO, Changpeng "CZ" Zhao came under fire when Binance suspended Dogecoin withdrawals to address a technical issue.

The problem has lingered for weeks, leading the DogeArmy to demand that Binance Release the Doge.

On Tuesday, in response to an article about Binance's global ambitions, Elon called out CZ.

CZ responded by shifting blame to the recent Dogecoin Core 1.14.5 update and posting an article about a Tesla safety recall.

Elon stood his ground, clarifying that he was raising the issue to protect the Doge community.

Appearing to sense a scandal, CZ backpedaled, admitting that he overreacted to the implication that Binance's Doge difficulties were intentional.

In a video interview with Yahoo Finance, he added that he didn't take the exchange personally and hoped it would "give the Twitter community a little bit of entertainment."

The following day, CZ sent out an update apologizing for the delay and taking responsibility for the flub: "The issue occurred on Binance - and not other platforms - because we have a different technical wallet set-up for DOGE, due to the number of users we have."

Binance's relationship with the DogeArmy is nuanced.

Earlier this year, CZ drew suspicion from some Dogecoiners for the way it listed Shib.

An Indian exchange owned by Binance has prohibited Doge withdrawals for five months while allowing Shib from day one.

At the same time, Binance's early support for Doge allowed many people to join the community.

In February, CZ said Elon was one of his idols

Hopefully, Binance resolves the issue soon. In the last 24 hours, reports have surfaced that customers are once again able to withdraw Doge, while CZ announced a Doge/Tesla giveaway.

In the meantime, the DogeArmy has powerful ally watching its back.

The Great Exchange Exodus

Robinhood and Binance are not unique: exchanges are competing to convince people to custody Doge on their platforms.

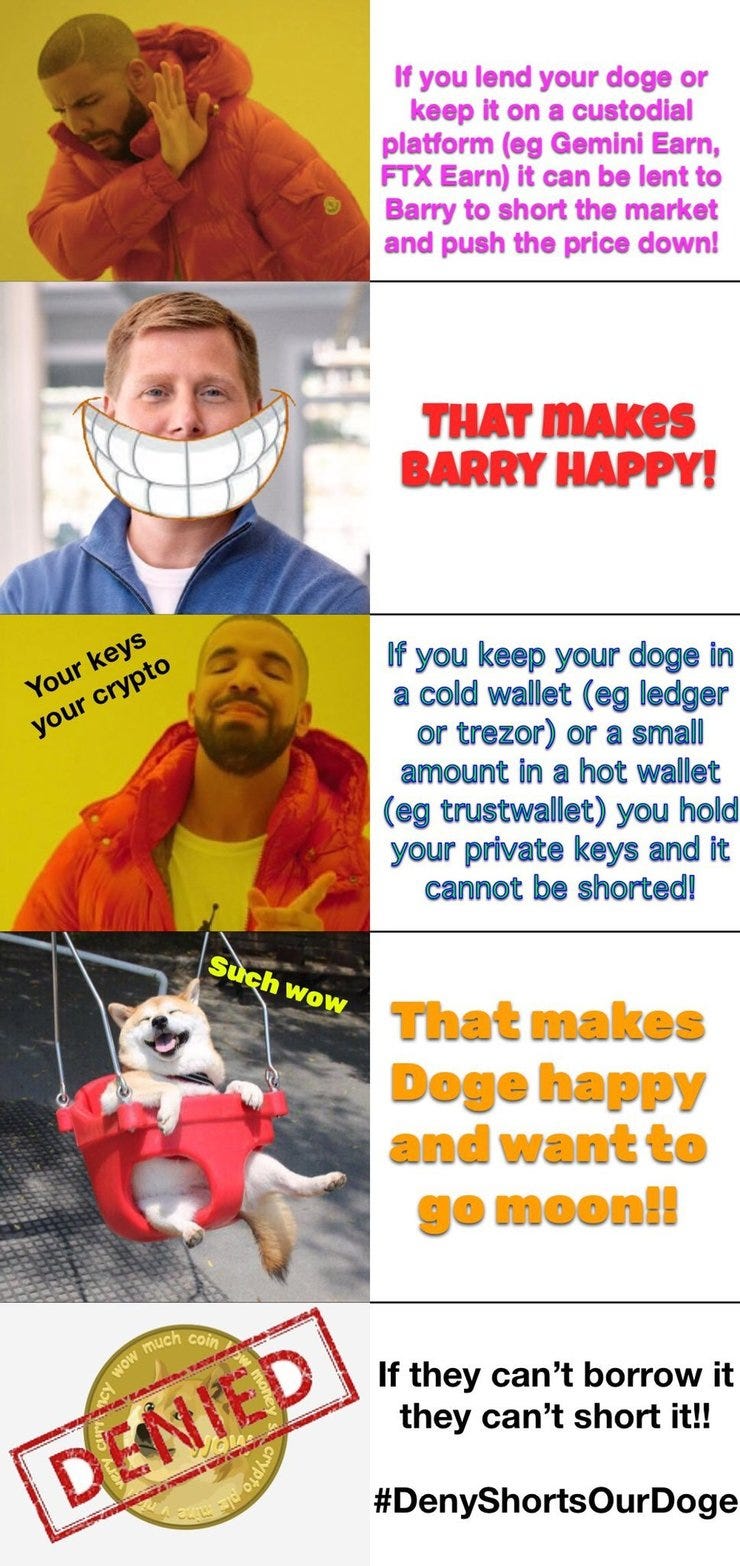

Some exchanges like Gemini and FTX offer lending programs that allow investors to earn interest on their Doge.

Lending programs can be very lucrative. Gemini pays people nearly 4% interest on any Doge they lend.

However, there is a dark side to these programs.

Exchanges that borrow crypto from investors can turn around and lend it to short sellers.

Too much short selling leads to downward price manipulation.

Twitter user @mishaboar has been calling on the DogeArmy to remove their Dogecoin from exchange-based lending programs for exactly this reason.

Elon responded to @mishaboar's tweet, calling it "Wisdom."

In January, Elon criticized the practice of short selling in a series of tweets, saying it was "legal only for vestigial reasons" and calling on retail investors to "Get Shorty."

For years, short sellers have been relentless in trying to suppress Tesla's stock price.

In a 2018 letter to employees, Elon claimed Tesla is the "most shorted stock in the history of the stock market."

A May 2021 report found that Tesla again had the highest short interest in the market.

Some voices have defended short-selling as an important practice for preventing asset bubbles.

It's also possible that competitors of Tesla or Doge—oil companies, other auto-makers, legacy banking—fund short sellers to slow down technologies that could disrupt the status quo.

On the day of Elon's SNL appearance, Grayscale Bitcoin Trust CEO Barry Silbert announced he was shorting Doge

Grayscale is the place where Wall Street goes to invest in crypto. It holds more Bitcoin than any other institution in the world.

By shorting Doge, Silbert implied that he saw it as a threat to Bitcoin's dominance.

Perhaps he was protecting the legacy system's interests, too.

If the DogeArmy were to collectively remove their Dogecoin from exchanges, it could cause a liquidity crisis for short sellers, making it very expensive to bet against Doge.

More importantly, it would send a message to Doge's enemies that the DogeArmy isn't going to tolerate any funny business.

There are some signs that the battle between exchanges and the DogeArmy could be coming to a head.

Wednesday night, the number of short bets on Doge hit an all-time high.

The shorts haven't slowed down since.

Clearly, someone is trying to shake the DogeArmy out of their coins.

A well-timed surge in Doge price could cause a cascade of liquidations for short-sellers.

In the meantime, many investors are taking advantage of the dip to pick up extra Doge on the cheap.

Get Shorty

Crypto exchanges are doing everything they can to hold Doge because doing so is profitable.

To live up to its billing as "the people's crypto," Doge must remain in the hands of regular people, not powerful centralized institutions.

The DogeArmy is using memes and collective action to hold exchanges accountable for their coins.

The battle is long, but the little guys are winning.

Retail is the whale. Soon, they'll be able to act like it.

Dogey Treats: News Bites

Elon threatened to give JPMorgan a one-star review on Yelp if it doesn't drop its lawsuit against Tesla, tweeting "Serious allegations deserve serious responses." He also said that 50% of his tweets are made on the porcelain throne.

Mr. Beast released a video of a real-life Squid Game.

Twitter CEO Jack Dorsey resigned.

$PEOPLE, the governance token of ConstitutionDAO, enjoyed a parabolic rally even as the DAO's twitter account announced the project was winding down.

$gm released a white paper.

Hillary Clinton called for more crypto regulation in an interview on MSNBC, citing crypto's threat to the dollar.

A Starlink user recorded download speeds of over 400 megabytes per second.

SpaceX and Nasa launched a rocket aimed at an asteroid to see how the asteroid's trajectory will change when struck.

Krause House is a DAO whose aim is to purchase an NBA team. Its acronym meme is WAGBAT.

Rams WR Odell Beckham Jr teamed up with CashApp to take 100% of his salary in Bitcoin. He is also giving away $1 million in Bitcoin. Is Tom Brady next?

Dogecoin is the most-googled cryptocurrency of the year, according to Markets Insider.

El Salvador announced the creation of Bitcoin City, powered by a volcano and funded by Bitcoin-backed bonds.

Several crypto CEOs will testify before Congress the week of December 8th, covering a variety of topics, including Crypto Twitter.

Mark Cuban proposed a model of journalism based on a DAO.

Thank You!

Thanks for reading! Consider sending a tip or Super Following on Twitter to help keep the newsletter going!

Doge: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

Memes of the week

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Will the DogeArmy keep exchanges honest? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow me on twitter at @itsALLrisky

Email me at itsALLrisky@gmail.com

Send a Doge tip: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.21 per coin.