First Republic Bank, Media Mayhem, WSJ's Epstein Scoop

Twitter News Digest for the week of 4/26-5/2

Hey everyone!

This week’s news digest covers the second-largest bank failure in US history, the ongoing battle between Twitter and the media, and Wall Street Journal’s big Jeffrey Epstein story. Don’t miss the Memes of the Week at the bottom.

Welcome to new subscribers! If you’re still not on our mailing list, sign up now for free!

First Republic Bank

Last week, First Republic Bank collapsed and was put into government (FDIC) receivership.

First Republic is the second-largest US bank ever to fail. It’s collapse is a sign that, despite assurances from financial authorities, the banking crisis which began in March is not over yet.

First Republic had been unsuccessfully trying to sell itself for weeks. Sunday night, the FDIC tweeted that it reached a deal with JP Morgan Chase, which will acquire its assets.

In order to convince JP Morgan to take on First Republic, the FDIC agreed to cover $13B in First Republic’s losses and loan JP Morgan $50B to make the purchase.

It also agreed to lift a rule that prohibits any bank from controlling more than 10% of total US deposits. JP Morgan now holds over $2.4 trillion in deposits, the most of any bank.

The move further consolidates power among banks deemed “too big to fail” by the government. Critics saw the acquisition as another step toward nationalizing the banking system.

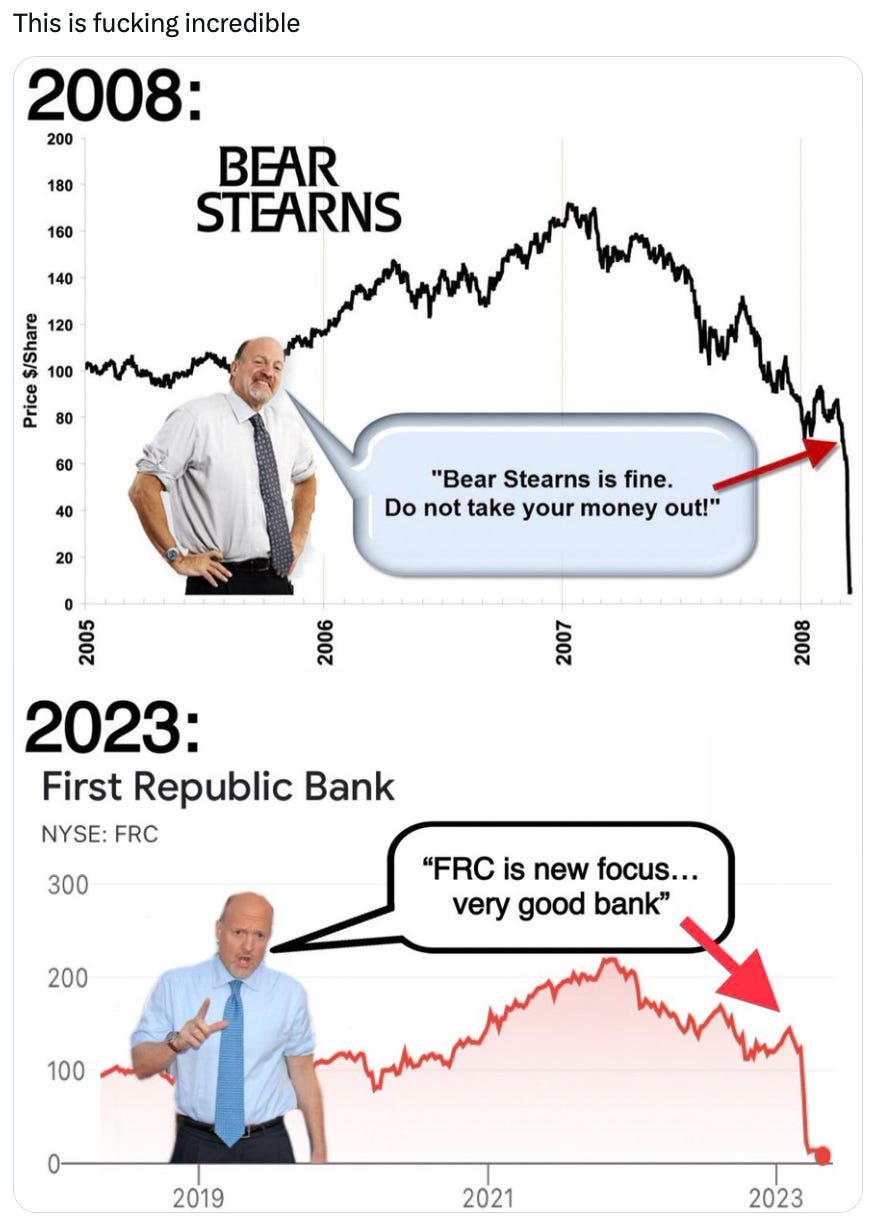

In a remarkable twist, the news further validated the viral “Inverse Cramer” meme.

After the first wave of bank failures in March, Jim Cramer tweeted First Republic was a "very good bank." Now, it is the fifth major bank to fail this year, following Silvergate, SBV, Signature, and Credit Suisse.

Late Sunday night, Elon gave a strong warning about the economy in response to a tweet by economist Larry Summers, using the bank failures as evidence to argue that a “severe recession” is approaching.

Monday morning, a US Treasury spokesperson said the banking system is “sound and resilient” and that Americans should have confidence in the safety of their deposits.

Tuesday, several regional bank stocks showed signs of distress, including PacWest Bancorp, Western Alliance Bank, and Metropolitan Bank. As it became clear that more regional banks were likely impaired, RFK Jr tweeted “The banking collapse is the tip of an economic mega-crisis.”

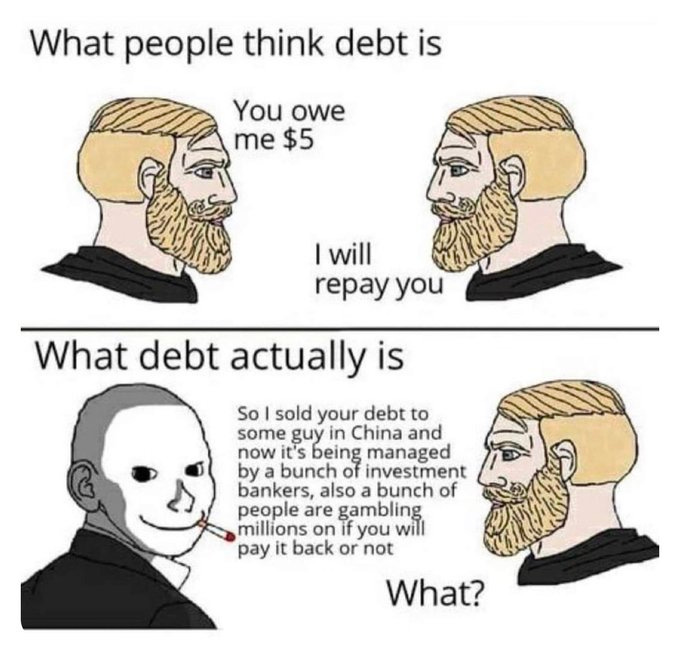

Amazingly, the banking crisis is playing out parallel to another financial mega-story: the debt ceiling negotiation between Congress and the White House.

This week, Treasury Secretary Janet Yellen warned that US could run out of money as early as June 1 if Congress doesn’t authorize the government to borrow more money.

Last week, House Republicans passed a bill to raise the debt ceiling. However, it is unlikely to pass the Democratic Senate because it calls for reductions in government spending.

Tuesday, the White House said it will not negotiate with Republicans, insisting the debt ceiling should be raised as a matter of formality.

Both the banking collapse and debt ceiling could transform the global financial landscape in the blink of an eye. Nothing is certain, which is why we’ll keep watching these stories here.

🚨 The rest of this article is for paid subscribers of It's ALL Risky. Your support helps us to provide a free newsletter every Monday, as well as bonus articles like this one. All proceeds go tow improving this newsletter. Subscribe below, and thank you for your continued support.🚨

Media Shakeup Continues

In last week’s news digest, I covered the ongoing shakeup in mainstream media, and the rise of Twitter as a competitor.

This week, Twitter and legacy media kept colliding. Here were some of the bigger happenings from the last seven days.

Tucker Carlson broke his silence with a video posted only to Twitter that racked up over 20 millions views. After his departure, ratings at Fox News tumbled. Tucker received a five year/$100M offer from Patrick Bet-David’s Valuetainment. Speculation has been rampant that Tucker will launch a new show on Twitter, possibly in collaboration with former Project Veritas founder James O’Keefe.

The New York Times reported that Vice News is headed for bankruptcy; critics pointed to its coverage of Covid-19 as contributing to its demise

RFK appeared on ABC and CNN to discuss his candidacy. ABC refused to run his comments on the Covid mRNA vaccines, after which he took to Twitter to criticize the network for censorship

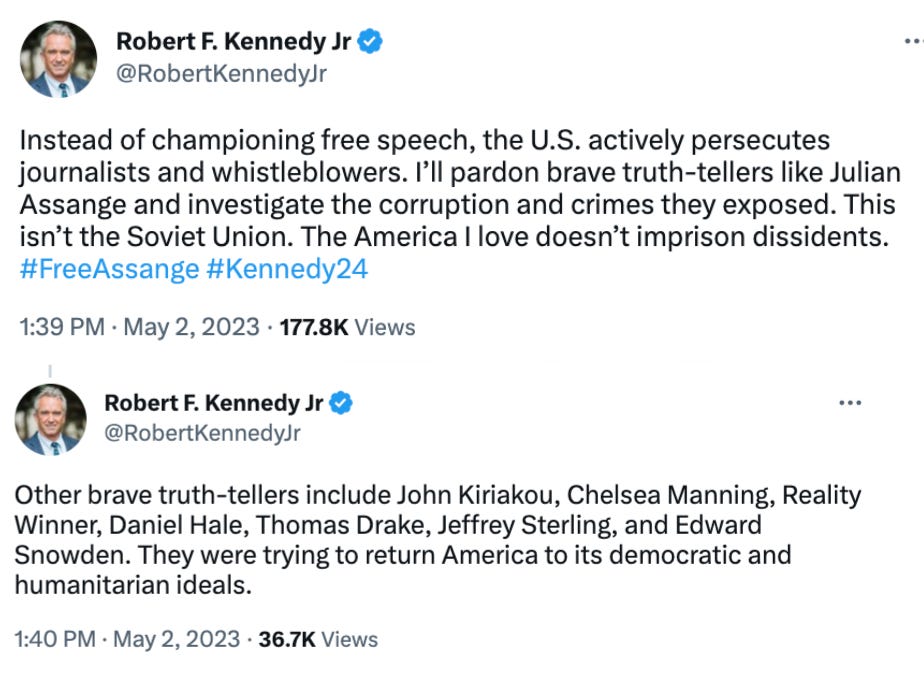

In another tweet, RFK Jr vowed to pardon Julian Assange, Edward Snowden, and other journalists and whistleblowers.

Friday night, Elon appeared on Real Time with Bill Maher to discuss Twitter, AI, censorship, and other topics

WSJ Epstein Bombshell

On Sunday, the Wall Street Journal published a bombshell article about Jeffrey Epstein.

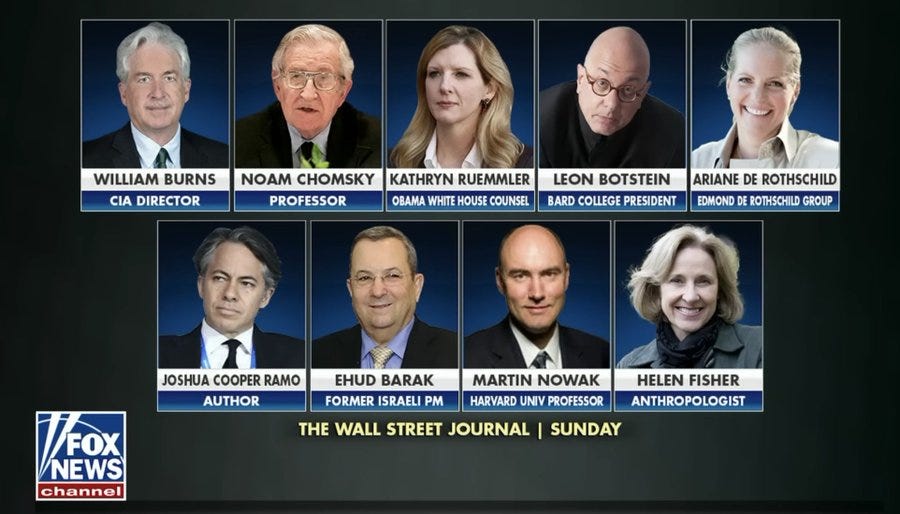

The article cited Epstein’s private calendar to show that he held meetings with several public figures, including current CIA Director William Burns, public intellectual Noam Chomsky, former Israeli PM Ehud Barak, Obama White House Counsel Kathryn Ruemmler, and banker Ariane de Rothschild.

All meetings took place in the years after Epstein was convinced as a sex offender.

The connection to Burns has increased speculation that Epstein served the intelligence agencies for one or more countries.

A spokesperson for the CIA said of Burns, “The director did not know anything about [Epstein], other than that he was introduced as an expert in the financial services sector and offered general advice on transition to the private sector. They had no relationship.”

After the news broke, podcaster Eric Weinstein asked if Epstein was a construct of the intelligence community.

In 2020, Weinstein published a courageous podcast in which he talked about his personal experience meeting Epstein.

Weinstein’s brother Bret focused on Epstein’s connection to other elites, writing “We can’t analyze Bill Gates’ behavior because we don’t know if Gates is doing things for his own reasons, or if he’s a puppet of something else, fully compromised by kompromat. Same for many with power and influence. Analysis is now all but impossible.”

Despite being dead for nearly four years, Epstein continues to be a source of fascination, in part because his name keeps popping up in headlines.

On Monday, a judge ruled that JPMorgan Chase could be held liable for damages relating to Epstein’s sex trafficking activities if it was determined the bank’s former CEO Jes Staley had knowledge of his illegal behavior.

Earlier this year, newly released emails between Staley and Epstein showed the two using Disney Fairy tales as code.

In March, Tucker Carlson told Full Send Podcast that Jeffrey Epstein did not commit suicide: “A friend of mine was one of the last people to talk with Epstein the day he was killed. He had a bail hearing in two days. He thought he was getting out.”

Elon’s Memes

Wolves and pigs

Friendly AI

How long has biased biased AI been training humans to think?

Dogey Treats: News Bites

Elon tested out a Periscope stream Tuesday night.

Twitter suspended an account promoting a pedophilia/Youth Attracted Person flag. Elon wrote, “Not tolerated on this platform.”

Mario Nawfal wrote a detailed thread explaining the rivalry between Elon Musk and the media.

Twitter has loosened its rules for cannabis companies advertising on the platform.

A new installment of the Twitter Files called “The Information Cartel” explored the Disinformation Industrial Complex. The author, Andrew Lowenthal, published an article on Matt Taibbi’s Substack.

Global Financial System

The Chinese Yuan surpassed the dollar as the most-used currency for Chinese cross-border trade. Elon said it was “quite a change.” Argentina agreed to pay for Chinese imports in Yuan rather than dollars.

Billionaire hedge fund manager Stanley Druckenmiller is shorting the US dollar. Hillary Clinton warned about the debt ceiling’s impact on de-dollarization.

Brazilian President Lula da Silva said he supports the creation of a special trading currency for BRICS nations. Syria called to replace the dollar with the Chinese yuan.

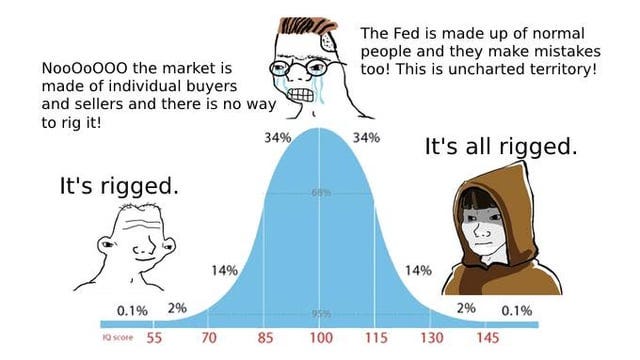

US Fed Chair Jerome Powell said during a prank call with two Russians posing as Ukrainian President Zelensky that he is planning at least two more rate hikes. Bloomberg confirmed the prank, which took place in January, was real.

RFK Jr posted an article arguing that the government’s war on crypto caused SVB, Signature, and Silvergate banks to collapse.

Artificial Intelligence

Another AI Drake Song dropped called, “Can’t Stop.”

A healthcare study found that patients preferred an AI chatbot to an actual physician 79% of the time. Chatbot responses were rated higher for both quality and empathy.

Geoffrey Hinton, the “Godfather of AI,” left Google so he could talk about dangers of AI without impacting the company. Elon tweeted, “Hinton knows what he’s talking about.”

Elon met with Democratic Senate majority leader Chuck Schumer and other Senators about AI and the economy. After the meeting, he tweeted of Schumer, “This is a man who cares about the American people.” Elon also met with the President of South Korea, who asked him to build a Tesla factory in his country.

IBM reportedly plans to replace 7800 jobs with AI.

US Politics

AOC and Matt Gaetz teamed up on a bi-partisan bill to restrict congress members and their spouses from trading and owning stocks.

Joe Biden warned North Korea about using nuclear weapons: "Nuclear attack by North Korea... will result in the end of whatever regime that would take such an action."

RFK Jr promised to prosecute any public officials who engaged in criminal wrongdoing during the law during Covid in a thread about Anthony Fauci. He appeared on “Clay and Buck” on Thursday to talk about his challenge to Joe Biden. A recent Emerson poll had RFK winning 21% of Democratic votes. David Sacks wrote, Is there a single other prominent Democrat who’s willing to criticize Covid “mandates, lockdowns, censorship, & insanity”? I hope @RobertKennedyJr succeeds in reclaiming — and restoring — the Democratic Party of his father and uncle.”

In a public event, Independent journalist Jose Vega confronted executive editors for the New York Times, Washington Post, LA Times, and Reuters for their failure to report the Nord Stream 2 pipeline bombing.

The World Health Organization (WHO) says there's a "high risk of biological hazard" at a laboratory caught up in the ongoing conflict in Sudan.

Congressman Matt Gaetz called for the removal of US troops from Somalia.

An HHS whistleblower named Tara Lee Rodas testified to Congress that the US government is acting as a “middleman” in a large child trafficking operation at the border.

Crypto

Bitcoin’s hash rate hit a new all-time high and had its largest five-day increase ever. Is Russia responsible?

Hong Kong will roll out new crypto exchange licensing guidelines in May 2023. The rules are expected to go in effect on June 1st, allowing retail investors to invest in crypto.

A 2018 clip of SEC chair Gary Gensler saying most cryptocurrencies were not securities went viral and caught the attention of Coinbase CEO Brian Armstrong. Coinbase opened an International Exchange.

The White House is proposing a 30% tax on electricity used to mine crypto.

Binance removed restrictions on Russian users.

Kraken filed a lawsuit against the IRS for what it calls “burdensome” and “unconstitutional” tax reporting requirements.

Misc

Comic Dave Smith appeared on Joe Rogan and called for prosecution of government figures who used Covid to break the law, echoing a statement by RFK Jr. Smith also said that censorship creates fake scientific consensus, the DNC does not want to let Joe Biden debate RFK because it will make the President look bad, and Trump proved the existence of a Deep State.

The Trump campaign released a surprising ad about the Great Reset.

A Washington Post article acknowledged document leaks claiming that the number of dead Ukrainian soldiers was five times what has been publicly disclosed.

GameStop chair Ryan Cohen tweeted, “America is littered with managers making millions in risk free compensation.” He later tweeted, “Corporate America is a wolf in liberal’s clothing.”

A study found a surge of young people turning to religion.

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on Twitter to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? What was the biggest story of the week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on twitter at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.08 per coin.