Dogecoin Takes on the Establishment

THIS Is Why Your Next Bank Will Hold Dogecoin

Hey everyone,

Twenty years ago, Elon Musk hatched a plan to disrupt the banking system with PayPal.

His goal was simple: make PayPal the place “where all the money is,” rendering traditional banks obsolete.

The plan didn’t work, but a lot has changed since then.

Let’s take a look at why legacy finance is primed for disruption, and how the combination of 𝕏+Doge could become the new digital bank.

Thanks for reading The People’s News for the People’s Coin—𝕏’s first open-source newspaper.

Are you hearing about Elon Musk a lot these days?

My 𝕏 subscribers and I are reading Walter Isaacson's new biography about Elon Musk to demystify the man behind the Mars mission.

Check out this free sample post from last week to see what we’re up to, and subscribe via my profile to join our Group Read!

Last week, I found an interesting clip of one of Elon’s old interviews.

In the clip, he explains how his original goal with PayPal was greater than just transacting money over the Internet.

Instead, he wanted to create a one-stop-shop digital financial system—with checking, debit cards, loans, and brokerage services, all available on a single website.

The goal was to make it so people never had any reason to take money out of PayPal: “It would just suck all the money out of the banks, and the banks would go away.”

But why should we trust Elon or one of his companies instead of the banks? Doesn’t everything work fine already?

When Elon started X/PayPal in 1999, there wasn’t an obvious need for an alternative system.

But today, we’ve been through at least two major financial crises. There’s no evidence the financial system has been reformed to the point where a 2008- or 2020-style financial collapse couldn’t happen again.

At the same time, we’re at a point where digital technology could easily replace older banking infrastructure with something simpler, more efficient, and less corrupt, with a transparent focus on serving users instead of financial conglomerates.

Three big stories from last week illustrate why the the financial establishment is primed for disruption. Legacy finance is looking shaky—here’s how 𝕏 and Dogecoin could turn the tables on the old guard.

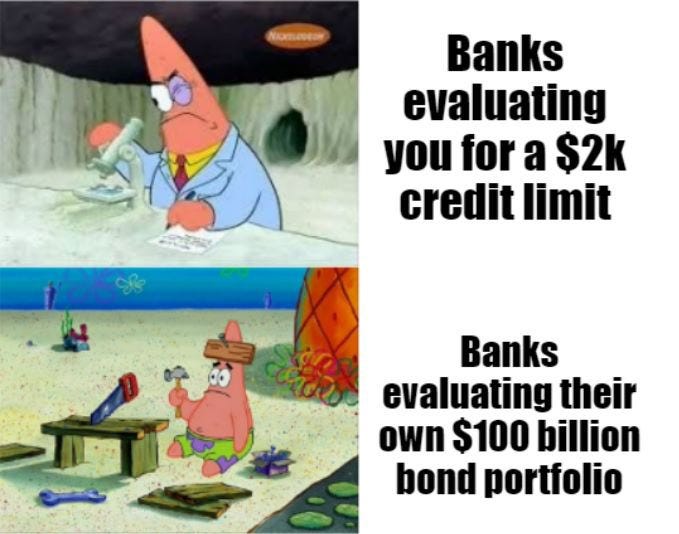

I. Gambling Banks

Earlier this year, Silicon Valley Bank and First Republic Bank collapsed.

The reason is that both banks invested customer deposits in securities, as all banks do. When the Federal Reserve raised interest rates, the securities lost value.

Word got around that the banks were sitting on large unrealized losses, and a bank run ensued. Neither bank had enough cash on hand to make their customers whole.

At the time, the government stepped in to guarantee customer deposits, effectively bailing out the banks. Online, people expressed concern that many other banks could also be sitting on large unrealized losses.

In the months since, there has been no further banking crisis, but signs of financial distress in the system have persisted.

For example, last week Reuters reported that Bank of America has over $130B of unrealized losses. BofA issued a statement that it planned to hold the securities to maturity and did not expect to take any losses over time.

The concern is larger than just BofA though. A recent estimate by Moody’s claimed that US banks could be sitting on a whopping $650B in paper losses combined.

Banks appear to be feeling the heat: Another report from the Daily Mail said that big US banks closed 54 branches in the first week of October, and over 2000 last year.

Then, on Thursday, CNBC reported that banks have been quietly laying off employees.

Any one of these data points might just be noise. But history suggests that it’s only a matter of time before banks need another government bailout to keep the financial system from going under.

At a moment when the average consumer is getting crushed by inflation, the idea of another major transfer of wealth from taxpayers to Wall Street could spark a populist revolt on the order of Occupy Wall Street or the Reddit Rebellion.

It’s reasonable to wonder if Elon’s plans with 𝕏 and Dogecoin are being made in preparation for just such a moment.

II. Fraudulent Firms

Last Friday, New York Attorney General Letitia James filed a complaint against Digital Currency Group and its CEO, Barry Silbert, for financial fraud.

DCG is Wall Street’s biggest crypto shop, in some ways functioning like a Bitcoin bank.

Like legacy banks, DCG made risky bets with money that wasn’t theirs. When the bets went bad, leadership lied about it.

The complaint is civil, but accuses Barry Silbert of repeatedly breaking criminal law by lying to make his company’s financial position seem stronger than it was. Another CEO likened DCG to Enron.

Silbert famously shorted Dogecoin at its peak in May 2021, urging Doge holders on Twitter to convert to Bitcoin.

It’s clear Silbert was trying to protect his own interests by dissuading regular people from investing in Dogecoin. DCG’s flagship product is Grayscale Bitcoin Trust, the largest known holder of Bitcoin in the world.

Bitcoin used to be the bleeding edge of financial rebellion, but Wall Street has managed to co-opt the revolution through investment vehicles like Grayscale. More recently, BlackRock’s entry into Bitcoin ETF is a sign that BTC is the territory of big money.

Silbert’s targeting of Dogecoin was a tell that the financial establishment fears Doge more than any other cryptocurrency. If you want to fight the Wall Street firms, Doge is the way.

III. Corrupt Regulators

On Saturday, Elon highlighted a post about the perils of regulatory overreach.

The post was from Vlad Tenev, who warned about a new SEC rule proposal designed to limit financial service companies’ use of technology.

Vlad is the founder of Robinhood, the popular retail stock/crypto investing app. He wrote, “The SEC admitted that the rule would be so difficult and costly to comply with…that firms might be forced to stop using technology to serve customers altogether.”

The SEC’s proposal covers any sort of algorithmic tech that could have an impact on investor behavior. So for example, an app like Robinhood could be restricted from using data to recommend news articles to users based on stocks they’re invested in.

The rule is good example of how agencies couch regulation in the language of “safety” but are actually concerned with preserving the status quo for big money by making it expensive and onerous for competitors to challenge legacy behemoths.

The rule likely caught Elon’s attention because it could hamstring his plans to turn 𝕏 into a one-stop financial services app.

In another development last week, news broke that Elon and Mark Cuban had filed a joint legal brief with the Supreme Court against the SEC. Both billionaires have made made a habit of publicly supporting Dogecoin.

The complaint targets the SEC’s practice of using in-house trials and judges. The brief said, “It is important that the SEC not be permitted to pick and choose whether parties are granted their constitutional right to jury trials or are forced to proceed in enforcement proceedings with administrative law judges immune from proper and meaningful oversight.”

In the legacy finance landscape, the SEC is the crooked cop on the beat that pretends to keep everyone safe, but actually runs a protection racket for the Money Mafia.

Earlier this month, Elon called out the SEC, predicting a 100% chance that its corruption would come to light.

Whenever it does happen, it’ll be interesting to learn which supposedly impartial bureaucrats are on the take from Wall Street.

When Elon started X.com/PayPal two decades ago, the idea of an alternative financial system probably struck most people as unnecessary, and maybe a little bit crazy.

Events from the last twenty years have reshaped the landscape. Over time, it’s become increasingly clear that regular people would benefit from having an alternative to the Wall Street blob—the network of banks, firms, and regulators that enforce the rules for world finance.

Today, the establishment is still fighting to protect its turf. But its position is weaker than ever, and its corruption has become plain for all to see.

As a technology, Dogecoin allows people to disconnect from the legacy financial system, while still storing and transacting with their money online.

When 𝕏 fully integrates Dogecoin, the platform could become the place where all the money is, including dog money.

What do you think: Is legacy finance primed for dispruption? And will Elon complete the circle of his vision for PayPal with 𝕏 and Dogecoin?

Dogey Treats: News Bites

GEC gave another update for DOGE-1.

BlacRock’s Bitcoin ETF was assigned a CUSIP number and ticker: IBTC. SEC commissioner Hester Peirce said, "the logic for why we haven't [approved a Spot Bitcoin ETF] has always mystified me."

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

Memes of the Week

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? Are Dogecoin’s best days ahead of it? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.06 per coin.