Dogecoin Solves the Generational Wealth Gap

Hey everyone,

The generational wealth gap in America is out of control.

As young Americans struggle financially, they are starting fewer families than ever before.

Elon has taken notice, calling population collapse an existential threat to civilization.

Legacy markets are stacked against newer participants, causing young people to increasingly turning to crypto as an efficient way to build wealth.

Now, Tesla is giving Dogecoin a trial run as a currency in the emerging digital economy.

Like Bitcoin before it, Doge could catalyze a transfer of wealth to younger Americans. Let’s take a look at how it could go down.

The generational wealth gap

Some degree of financial inequality is to be expected among generations.

Older Americans have spent more of their lives working, so it isn't surprising that wealth distribution skews toward Baby Boomers and Generation X.

Still, Millennials are getting smoked by their elders when it comes to building wealth.

Over the last decade, economic conditions have made it a challenge to build wealth from scratch.

For Millennials and Zoomers who've spent their working lives in a regime of flat wages, college debt, and rising inflation, the stock market's 10% yearly return on a few thousand dollars of savings doesn't offer a ton of hope.

Recently, hedge funds and wealthy individuals have started using real estate as a store-of-value asset, rather than a place to live, nudging homeownership out of reach for many younger people too.

A certain amount of economic inequality is inevitable in any competitive, merit-based system.

Pushed too far, however, it can threaten civilization itself.

Declining fertility

Generational inequality threatens civilization by putting downward pressure on fertility.

Millennial birth rates, already low, took another hit during the pandemic, likely due to economic uncertainty and social isolation.

While some hoped for a post-Covid baby boom, the media-hyped "Hot Vax Summer" never materialized.

The recent dip in birth rate is part of a larger downslope.

In America, births per 1000 people has been steadily dropping for the last 60 years, from 24 per thousand in 1960 to 12 per thousand today.

Families are the backbone of the middle class, and a robust middle typically leads to a strong country.

For this reason, economic policy typically encourages family formation.

The opposite has happened over the last decade: federal institutions have consistently prioritized protecting the wealth of already wealthy Americans and legacy financial institutions.

Monetary policy emerges from the Federal Reserve—a private bank that isn't directly accountable to the public—while the President and Congress set the budget.

All of these institutions are heavily weighted with entrenched power, making reform difficult.

Underrepresentation has also prevented younger cohorts from passing the kind of legislation that could eliminate endemic corruption and level the financial playing field.

If these imbalances aren't addressed soon, the consequences for civilization could be disastrous.

With a whimper

With the oldest Millennials entering their 40s, the window is starting to close on some would-be families.

Elon has taken notice of these trends, arguing that population collapse is a greater threat to humanity than overpopulation.

He's also critiqued lopsided political representation among generations, calling the existing power structure a "gerontocracy."

Last Monday, he pushed the discussion forward by connecting birth rate and generational power with a cheeky tweet.

At any other moment in history, young folks would remain trapped in the bottom of the pyramid.

In 2022, by a miraculous quirk of good fortune they've been given an escape hatch.

Every generation has its ponzi

Mined on January 3rd, 2009 in the depths of the financial crisis, the genesis block of the Bitcoin blockchain contains a headline from The Times: "Chancellor on brink of second bailout for banks."

This sly commentary by pseudonymous Bitcoin creator Satoshi Nakamoto established a link between the self-dealing practices of the legacy system and the creation of an alternative digital economy, suggesting the latter is a necessary response to the former.

Since Bitcoin's inception, legacy institutions have fought it tooth and nail, often deriding it as a ponzi scheme.

Usually, this criticism is not made in good faith.

Most legacy financial vehicles are no less ponzified than Bitcoin in the sense that they depend on constant inflows of funding from new participants to stay solvent.

If people were to stop participating in fractional reserve banking or Social Security, they'd quickly collapse.

Despite headwinds from the old guard, Bitcoin has gained roughly 200% in value per year, making it the best performing asset of the last decade.

As the pandemic pushed more of life online, the tide has turned decisively.

Banks, cities, companies, and even countries are now plugging in to the new digital economy to avoid getting left behind.

In 2021, during a banner year for the S&P, Bitcoin still outpaced it by 30%. Bitcoin has become the apex predator of financial markets.

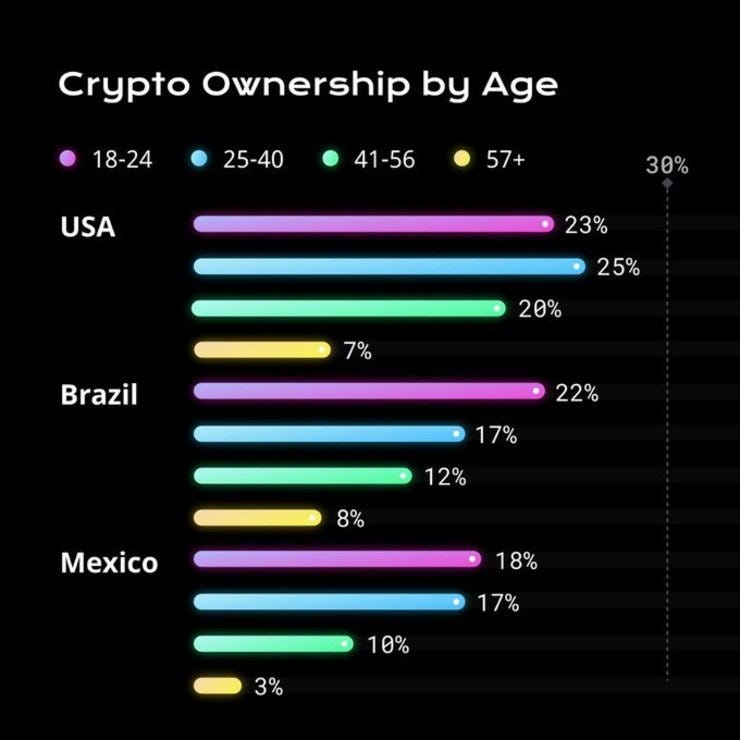

Most of these gains are going to younger, digitally-native cohorts who dominate crypto ownership.

Legacy finance dislikes Bitcoin and crypto not because it's a ponzi, but because it threatens to disrupt their own ponzi.

Tesla Dogenomics

People are flooding into crypto because it is offers asymmetric returns they can't get from other investments.

Built on a culture of memes, it's also more fun than the legacy system.

No crypto can match Dogecoin in terms of fun factor. In essence, Doge is an extra-fun version of Bitcoin.

In 2021 percentage gains, Bitcoin trounced the S&P, but was one-upped by Dogecoin.

Banks have taken note. Criticism typically reserved for Bitcoin is now being directed toward Doge too.

This summer, the President of the Minneapolis Fed specifically called out Dogecoin as a ponzi.

By contrast, Elon has described Dogecoin as "the future of currency."

Doge is looking less like a ponzi and more like a real money every day.

On Thursday night, Tesla started allowing customers to pay for select merch with Dogecoin.

Dogecoin is now the only crypto in the world accepted by a Fortune 500 company.

Tesla priced items directly in Doge. In a show of strength from the DogeArmy, several items sold out.

Tesla is starting small with merch, but things could quickly escalate.

The merch news dropped two days after people discovered several references to Dogecoin in the code that governs Tesla's vehicle payments.

If Tesla decides to keep payments as Doge rather than converting them back to fiat, it will become one the world's largest Dogecoin whales.

The world's most exciting company could soon be swapping self-driving electric cars for dog-meme money. Amazing!

Can Dogecoin save civilization?

In 2022, young Americans are badly in need of a way to close the wealth gap.

Legacy finance profits from existing hierarchies. It will fight to keep keep younger generations locked in at the bottom layer of the economic pyramid, with disastrous consequences for civilization.

Cryptocurrency offers an escape hatch from this mess, creating an opening for a large-scale transfer of wealth from the legacy system.

Tesla is one of the most forward-looking companies in the world. It has chosen Dogecoin as its preferred crypto medium of exchange and looks like it's getting ready to accept Dogecoin for vehicles.

Can Dogecoin turn things around for civilization and get the birthrate moving in the right direction? The most entertaining outcome is the most likely.

Dogey Treats: News Bites

A report by the twitter account @unusual_whales is spurring a bipartisan push to ban congressional stock trading.

Elon tweeted a Starlink update, sharing that 1469 satellites are now active and "Laser links activate soon."

Banking officials gathered for a war game, "Collective Strength," simulating the collapse of the global financial system.

Elon tweeted, "The most entertaining outcome is the most likely" in response to a Billy Markus tweet about the creation of Dogecoin.

A meme-filled music video explaining DeFi trended on WorldStarHipHop.

Cathy Wood estimated that crypto assets would be worth $40 trillion by 2030.

The Twitter account Cozomo de' Medici, believed to be Snoop Dogg, called for a year round 1 of 1 NFT szn and announced a new digital aristocracy, the #HouseOfMedici.

Citadel Securities took a $1.15 billion dollar investment from VC firms Sequoia Capital and Paradigm, signaling its entrance into crypto.

Lil Baby: I stay in the metaverse.

Congressman Tom Emmer proposed a law to prohibit the Fed from directly issuing a Central Bank Digital Currency to consumers.

Details about Robinhood crypto wallets were released, including a transfer limit of $3,000 per day.

Federal Reserve Chair Jerome Powell said that private stablecoins can co-exist with a digital dollar.

Nancy Pelosi's son Paul, a San Francisco-based investor, was involved with five companies probed by federal agencies for corruption.

Mark Cuban continues to defend Doge on Twitter.

Bitcoin could become legal tender in Tonga in 2022.

Moxie Marlinspike is CEO of the encrypted messaging app Signal. He posted a document of his first impressions of Web3. Elon called the post "accurate."

Financial regulator FINRA ruled that Robinhood was liable for damages to a retail trader as a result of pauses on meme stocks in January 2021.

Jimmy Fallon and Shaq tweeted 'gm.'

Tesla released Q4 safety data showing big differences in accidents between autopilot and human drivers.

Klay Thompson and Andre Iguodala are accepting part of their salaries in Bitcoin.

Reese Witherspoon tweeted: "In the (near) future, every person will have a parallel digital identity. Avatars, crypto wallets, digital goods will be the norm. Are you planning for this?"

Memes of the week

Thank You!

Thanks for reading! Consider sending a tip or Super Following on Twitter to help keep the newsletter going!

Doge: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Will Dogecoin save civilization? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow me on twitter at @itsALLrisky

Email me at itsALLrisky@gmail.com

Send a Doge tip: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.19 per coin.