Dogecoin: Security, Commodity, or Currency?

THIS Is Why Coinbase Is Calling Doge A Commodity

Hey everyone,

Cryptocurrency is novel technology without historical comparison. For this reason, it’s tough to use existing laws to classify them.

Over the last few years, a fierce debate has raged: Should cryptos be treated like stocks? Or are they closer to commodities like gold? Or should we recognize them as money like the dollar?

Last week, Dogecoin moved closer to clarity when Coinbase filed to list it as a commodity.

Let’s take a look at why this such a big deal, and what regular folks can do to advance the reality that Dogecoin is money

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

A major piece of news just dropped with big implications for Dogecoin.

Earlier this month, Coinbase filed with the Commodities Futures Trading Commission (CFTC) to launch Dogecoin futures contracts.

The contracts allow investors to buy and sell large amounts of Dogecoin. They are expected to go live next week.

The most interesting thing about Dogecoin futures is that Coinbase classifies Doge as a commodity in order to write the contracts.

Cryptocurrencies are a novel invention that don’t easily fit into traditional categories. One of the longest-running debates in crypto is what cryptocurrencies really are.

There are three possible classifications for cryptos: securities, commodities, and currencies.

Security: ownership of a company/government with the expectation of profit (stocks, bonds, mutual funds, ETFs)

Commodity: a basic good used in commerce that is interchangeable with other goods of the same type (gold, oil, wheat)

Currency: a system of money used by a particular country (Dollars, Yen, Pesos)

Based on their name alone, you’d think cryptocurrencies are currencies, right?

It turns out “cryptocurrency” is aspirational term. Governments have been slow to recognize crypto as legit money for several reasons.

The ability to deem something money is a special power reserved by the state. Allowing private citizens to make their own money undermines state power.

Recognizing crypto as legal tender could threaten a country’s existing money if too many people decide they’d rather use crypto instead.

Cryptos are harder to control—countries can easily print more of their own money or seize it from criminals, but lacks these powers over crypto

Cryptocurrencies are historically more volatile than fiat currencies; governments don’t recognize crypto as money under the justification that they are protecting citizens from financial instability.

Since World War II, the global financial system has run on the dollar. During this time the US has closely guarded its power to decide what counts as money.

In order to protect the dollar, the US hasn’t recognized any cryptocurrencies as money. Outside of the US, only two countries have fully broken from this policy: El Salvador and The Central African Republic.

When the US does try to classify a crypto at all, it’s usually through the Securities Exchange Commission (SEC).

In recent years, the SEC has filed several lawsuits claiming cryptos are unregistered securities, which has a negative effect on both the cryptos themselves and the exchanges that list them.

If the US government recognizes Dogecoin as a commodity, it’d be a positive development.

Classifying Doge as a commodity means it is not a security.

Commodities are not subject to oversight from the SEC, one of the most anti-crypto agencies in the world.

The truth is that Dogecoin is money. However, it’s going to be an uphill battle to get the government to recognize this.

Perhaps the best outcome would be for regular people to lead the way by using Dogecoin to buy things.

Over time, authorities will have no choice but to enshrine reality into law, especially if the Dogecoin lobby grows powerful enough.

In the meantime, Doge’s impending classification as a commodity gives it protection from the SEC and its nefarious attacks on crypto.

Fortunately, the classifications of commodity and legal tender are not mutually exclusive.

It’s possible the government recognizes Dogecoin as a commodity today, and adds it as a form of legal tender in the future.

The move to classify Doge as a commodity is a step in the right direction. It’s an intriguing question why Coinbase is doing so now of all times.

Crypto is a novel invention in the world, and doesn’t easily fit into traditional financial categories.

Dogecoin is moving closer to achieving regulatory clarity than most other cryptos. Conbase’s latest move is a promising development.

Ultimately, Dogecoin isn’t just a commodity—it’s money. The government probably doesn’t want to recognize this, but the people have more power than they realize.

It’s great that things are lining up for broad recognition of Dogecoin, but there’s not reason to wait around for official approval. If people decide that Doge is money, then it is!

Dogey Treats: News Bites

Several accounts argued that Dogecoin, like Bitcoin, has a hard cap. Doge’s cap is reportedly 21 trillion coins, with the last coin set to be mined in 6100.

Coindesk ran an article asking, “Is It Late 2020 All Over Again for Dogecoin?

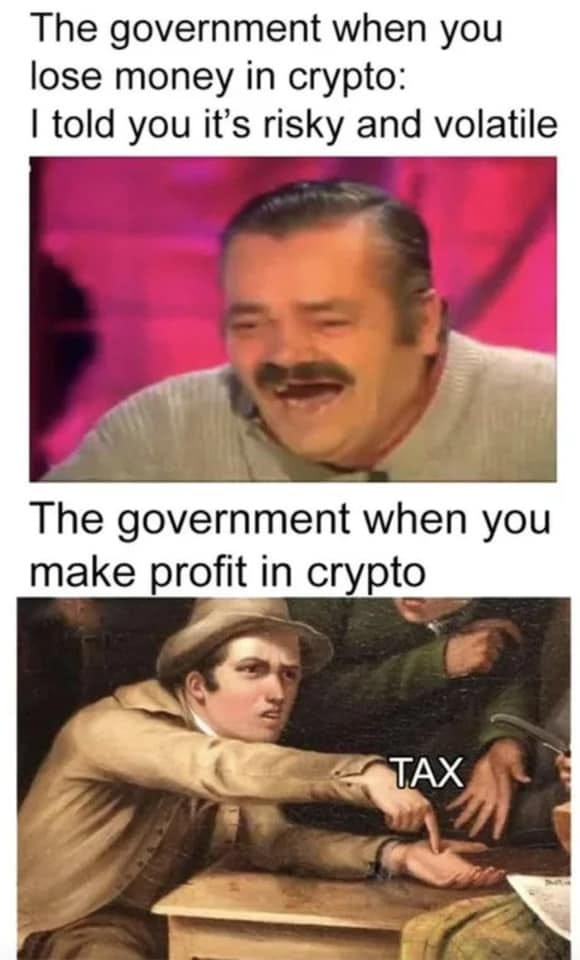

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? What was the biggest development for Doge this week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written by @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.17 per coin.