Dogecoin Is The New Financial Operating System

THIS Is Why Dogecoin Shifts Power From The State To The Individual

Hey everyone,

It’s an election year, and like all election years promises are flying around for how politicians are going to fix all the big problems.

One of the biggest issues is wealth inequality. The common solution is to tax the rich and redistribute it to the poor.

But the evidence is mixed at best that more government intervention will bring about equality. It’s worth considering the possibility that getting government out of the money game altogether might produce better outcomes.

Let’s take a look at why the idea of stateless money has been catching on lately, and how Dogecoin shifts power from the state back to the individual.

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

Over the last few weeks, a new proposal for an “ultra-millionaire tax” has been gaining attention as a solution to wealth inequality.

The plan proposes an annual 2% tax on individuals worth between $50M and $1B, with an additional 1% for people worth more than a billion.

But would an “ultra-millionaire tax” actually reduce inequality and improve the lives of regular folks? This is up for debate…

A lot of folks start with the default assumption that the government is benevolent, and higher taxes allow to carry out its friendly agenda more effectively.

Elon Musk has put forth the counter-argument that governments are best understood as giant corporations: they are a combination of people and technology with the goal of producing goods and services.

The main difference between corporations and government is that the latter has a monopoly on violence—it can put people in jail, seize property by force, and take lives.

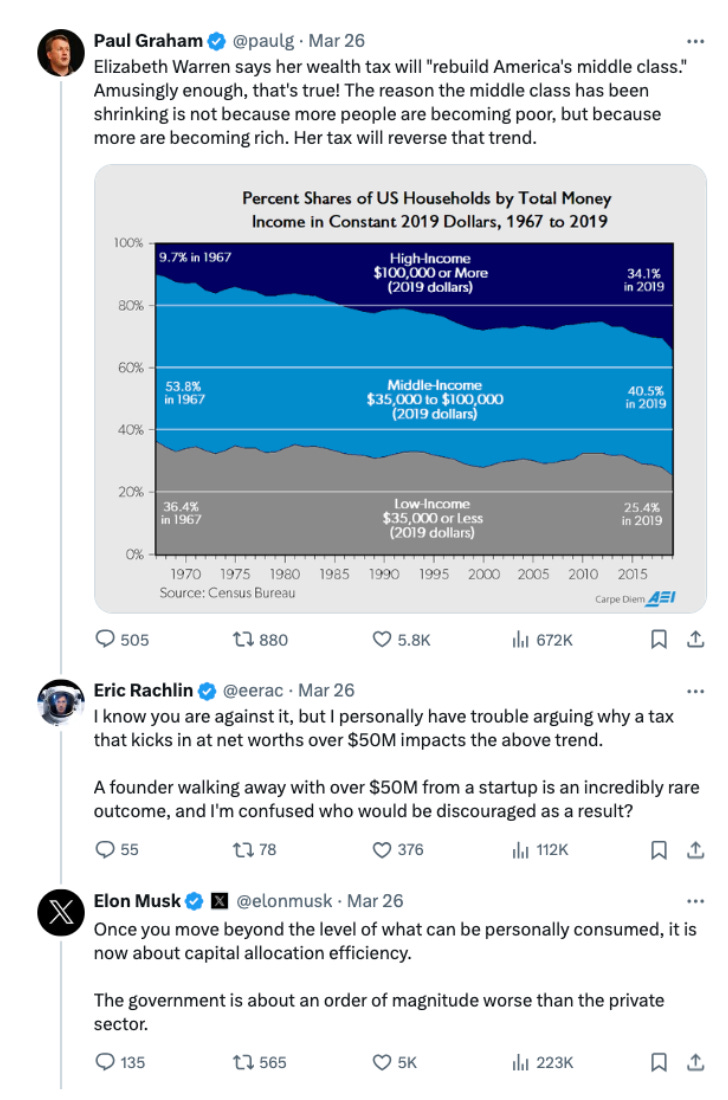

Elon has also faulted governments for being poor at capital allocation.

In a discussion last week about the “ultra-millionaire tax,” he argued that governments are typically “an order of magnitude worse than the private sector” at using money to improve people’s lives.

The difference between public and private sectors boils down to accountability: if a private rocket company doesn’t put out a useful product, it will quickly go bankrupt.

On the other hand, a government agency like NASA can burn billions of taxpayer dollars producing nothing of value for decades, yet continue to exist because it’s funded by taxes.

Government corruption is one reason agencies are so inefficient. Politicians who advocate for legislation favorable to corporations are often rewarded in the form of campaign contributions, job offers, speaking fees, book deals, and other financial perks.

Or they can simply trade markets with insider information from companies they’re supposed to be regulating.

Even when they’re not being corrupt, governments tend to spend a lot of taxpayer money on projects that are of questionable benefit to citizens, like wars, bank bailouts, foreign aid, and interest on money it already borrowed.

Elon concluded his argument by offering examples of countries that split in half, with one part practicing big-government communism and the other small-government capitalism.

Capitalism has its faults—especially the corrupt crony-capitalism of today’s America—but no other economic system can match its track record of raising the collective standard of living by producing more and better goods at cheaper cost.

Of course, inequality remains a huge problem today. But it’s very much up for debate whether increasing the size of government will fix it, or make it worse while enriching those close to political power.

If increasing government won’t automatically make things better, what other large-scale financial interventions exist to address inequality?

Online, one answer has been enjoying explosive popularity as of late: separate money and state.

Once you think of government as a corporation, it’s worth asking if you’d trust Amazon, Boeing, Monsanto, or Pfizer to run the money system.

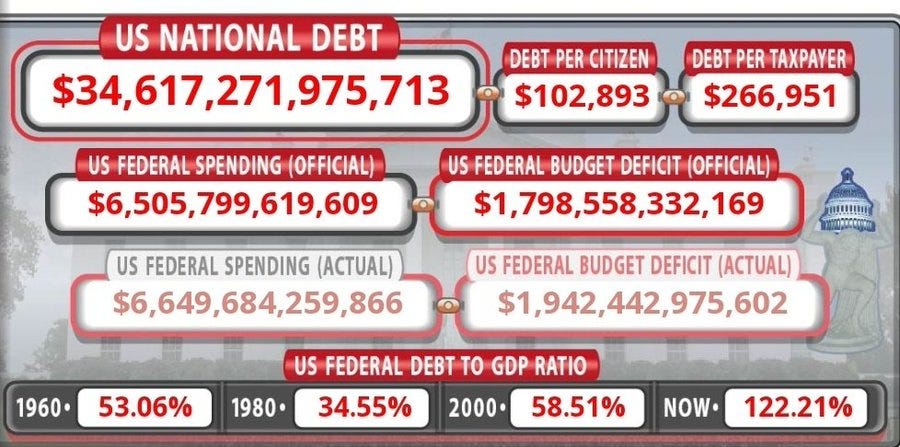

Data shows you’d be better off not trusting the government to preserve your money’s value. Just in the last four years, the government has devalued the dollar by a shocking 25%.

This loss of purchasing power represents a massive undeclared tax on everyone holding dollars.

Governments’ mismanagement of money power has become increasingly obvious as prices have shot up. But currency debasement isn’t new.

On the contrary, the dollar has been on a long historical downtrend. Like all fiat currencies, the dollar has become victim of government mismanagement of money—the more new dollars are created, the less each unit of currency is worth.

All of that purchasing power has to go somewhere. As the dollar has lost value, purchasing power has been redistributed away from regular folks holding cash to the banks, corporations, and government agencies that are the first recipients of newly created money.

There’s a strong argument to be made that things would be better if that wealth were preserved in the hands of individual citizens, who could use it to help each other out, start new businesses, or build up savings for a rainy day.

Right now, there are two main contenders for reducing governments’ money power.

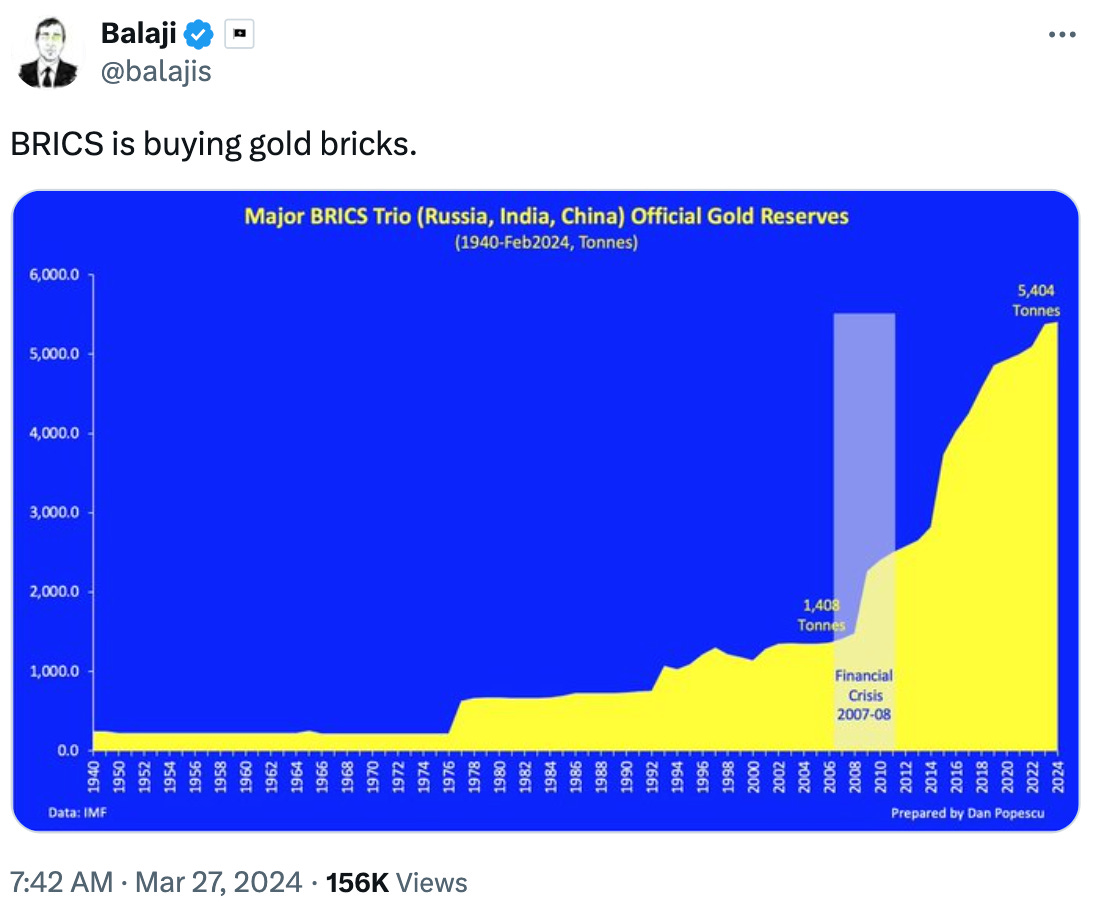

Gold is the classic form of stateless money. No single entity controls the supply of gold, and it’s impossible to create more out of thin air.

Anyone that wants more gold must expend real labor and energy to mine it, which acts as a check on governments that would otherwise print themselves free cash.

Most governments don’t like the idea of gold as money because it reduces their power. In the past, gold has even been made illegal by the US government.

Recently, however, a few countries have started stockpiling gold. It’s possible to understand their gold accumulation as a hint that a return to stateless money on the horizon.

Crypto is the other popular form of stateless money. Like gold, cryptocurrency doesn’t belong to any government or corporation.

Also like gold, acquiring “proof of work” cryptocurrencies like Bitcoin and Dogecoin requires real expenditure of energy through mining. This means they can’t be freely debased.

Crypto’s major advantage over gold is that it can settle transactions at light speed. It takes a small army of security guards to make a billion dollar payment in gold, but the same transaction can be performed for pennies in seconds using Bitcoin or Doge.

Ultimately, it’s possible to think of crypto as a new financial operating system.

Neither the government nor anyone else has special administrative privileges over this operating system, which belongs entirely to the people who use it.

The crypto system is also egalitarian by design: anyone with a cell phone and Internet connection access to digital banking services at virtually no cost.

Crypto’s challenge is that most of the world doesn’t use it yet.

This is where Dogecoin comes in. Doge stands out among cryptocurrencies for a couple reasons that make it the ideal starter-crypto:

Doge was created a joke and its creators did not profit off of it, bestowing it with an impossible-to-replicate purity

Doge started out as a crypto for online tipping, causing its ownership to be widely distributed

Doge has cheap transaction fees that make it ideal for small everyday purchases

Doge’s friendly, meme-based brand is great for onboarding new folks to crypto in a low-stakes way

Other stateless forms of money are directly threatening to government, but dog money is so silly that the money mafia would rather ignore it than challenge it head on

A lot of folks think the best way to reduce inequality is to increase taxes and grow the size of government. But government has at best a mixed track record of serving the people.

Cryptocurrency is a radical experiment in separation of money and state, and an alternative solution to reducing wealth inequality.

Rather than redistributing wealth from individuals to government, crypto proposes empowering individuals with a financial operating system that can’t be easily debased.

For now, crypto is speculative. It holds a lot of promise, but has yet to fulfill its awesome potential.

Among digital currencies, Dogecoin stands alone as the perfect vehicle for onboarding people to the new system.

A world with Dogecoin is more entertaining and promising than one without it. It might also be a fairer and more abundant one. Let’s see what happens…

Dogey Treats: News Bites

Williamsburg Pizza in Brooklyn hosted a Dogecoin community event.

The Dogecoin Foundation released its Gigawallet 1.0 to allow businesses to easily transact with Dogecoin. Dogecoin developer Timothy Stebbing explained the Foundation’s vision: “We aim to create a network of fully self-hosted, totally decentralized merchants selling products using their own wallets with no intermediaries, built on Dogecoin.”

Coinbase continued its “update the system” advertising campaign.

Memes of the Week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? What was the biggest development for Doge this week? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written by @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.20 per coin.