Dogecoin is finishing what GameStop started

Hey everyone,

A year ago, retail investors used social media to organize against the Wall Street establishment in what became known as the Reddit Rebellion.

The battle between the little guy and big money raged throughout 2021, as the initial flash uprising morphed into a long-term fight for market fairness.

Wall Street has the money, but the people have the memes. Let’s take a look at how the events of early 2021 are shaping the financial landscape to this day.

Power to the players

Last January, financial markets were briefly turned upside down in a chaotic series of events whose effects are still being felt.

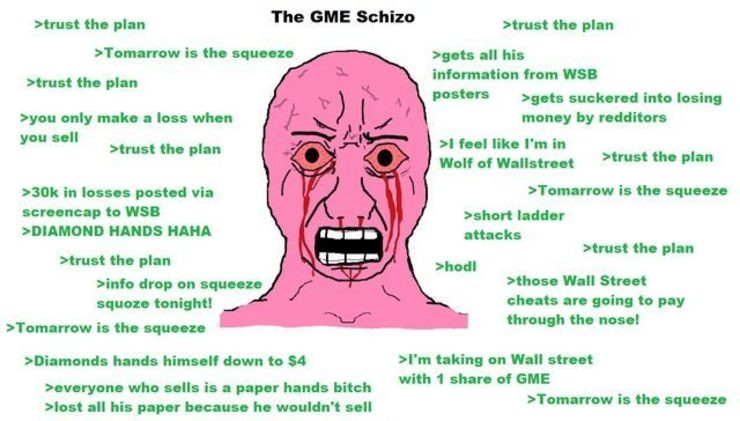

Acting on the research of Keith Gill—known on YouTube as RoaringKitty and Reddit as u/deepfuckingvalue—thousands of retail investors bought GameStop stock in order to squeeze for hedge funds who'd bet the company would fail.

If consummated, the squeeze would effectively transfer billions or even trillions from Wall Street to Main Street.

A large number of these investors used Robinhood trading platform, which enabled fee-free trading in exchange for collecting user trading data and selling it to hedge funds, a practice called "payment for order flow" (PFOF).

In this case, Robinhood was directing orders to Citadel Securities, the largest market maker in the US, run by CEO Ken Griffin.

Citadel was believed to be selling that data to hedge funds like Melvin Capital, who'd then take the other side of the trade by shorting heavily retail-owned stocks.

As GameStop exploded from $15 to $350 to start the year on the strength of retail buying, it appeared the little guy had found a way to fight back against the Wall Street bullies. The mythical Mother of All Short Squeezes appeared imminent.

The idea of tens of thousands forming their own decentralized anti-hedge fund over social media was a new, even revolutionary thing.

For once, it looked like the Main Street might win at the banks' expense.

Retail investors piled into AMC, BB&B, Nokia and other stocks with similar setups as GameStop, using the Reddit's r/wallstreetbets and Twitter to share due diligence and good vibes in the form of memes.

At some point, the term "meme stocks" was coined to describe the unfolding phenomenon.

Just as things seemed on the cusp of getting out of hand, on January 28th, Robinhood removed the buy button for meme stocks.

Stocks that can't be purchased can only go down. In subsequent days, GameStop plummeted to $40, while the other meme stock plays didn't materialize, leaving retail investors confused and bereft.

For a moment on Wall Street, order seemed to have been restored.

The battle continues

As the events transpired, Elon emerged as an important ally for the little guy.

A few days after the GameStock pause, Elon grilled with Robinhood CEO Vlad Tenev on Clubhouse, asking, "did something maybe shady go down here?" and "is anyone holding you hostage right now?"

Vlad told him Robinhood halted buying because the National Securities Clearing Corporation (NSCC), which works with Robinhood to execute trades, demanded RH increase its deposit by "an order of magnitude" to prepare for increased market volatility.

At the time, rumors swirled that Citadel pressured Robinhood to pause trading to protect their hedge fund clients.

Stymied by Wall Street, retail wasn't done kicking up dust. In many ways, the rest of the year was defined by skirmishes between meme-wielding retail investors and big money institutions intent on preserving the old order.

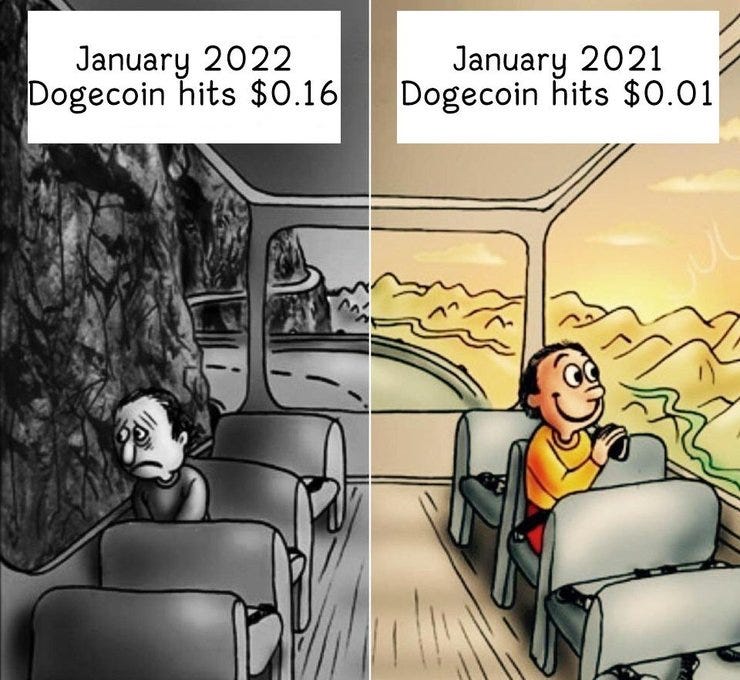

The spirit of the Reddit rebellion flowed into Dogecoin, the ultimate meme asset, which enjoyed a months-long parabolic run that began on the day of the GameStop pause and ran through May, when Grayscale CEO Barry Silbert announced he was shorting it.

Called to testify before Congress in late February, RoaringKitty doubled down on his original investment thesis, telling one questioner, "I like the stock."

Like RoaringKitty, many investors vowed to hold their investments with diamond hands until the market reflected their true value.

Devoted online communities developed around GameStop and AMC to dig in for a long battle. The dominant meme was "Apes aren't leaving."

June saw more meme stock action when AMC stock erupted from $12 to $60 over the course of a few days.

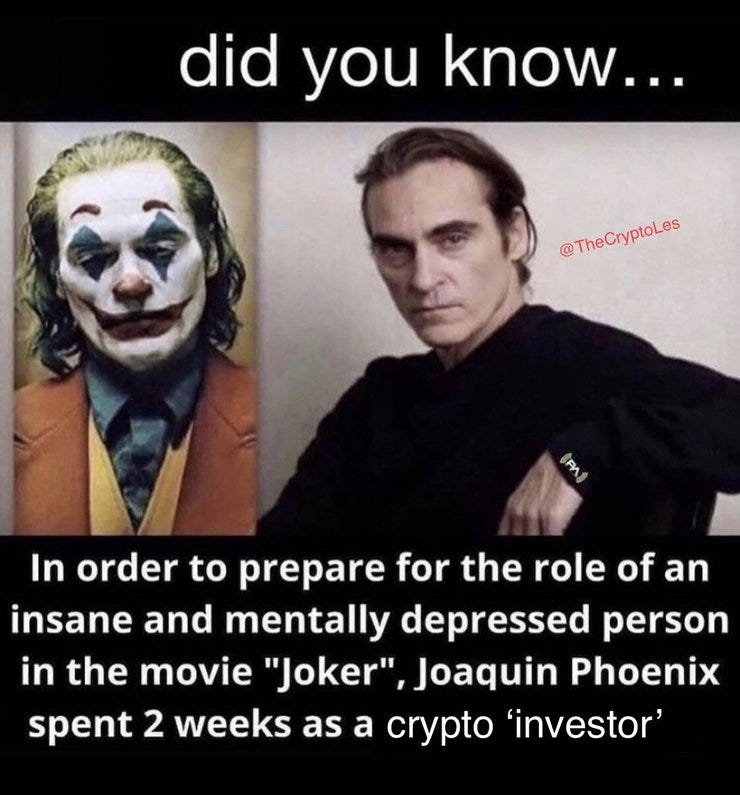

Meanwhile, the meme economy continued to grow. NFTs boomed in Spring and again in Summer as venture capitalists, celebs, and retail all kicked the tires of the growing market.

All the while, details from January continued to trickle out. Charles Payne of Fox Business was a rare voice of support for the plebs in the traditional media.

In September, the hashtag #KenGriffinLied began to trend on Twitter after internal messages between Robinhood and Citadel appeared to show showed coordination.

In October, Griffin told Bloomberg crypto is "a jihadist call" against the dollar, adding that he wished young people focused their energies on reinforcing the legacy financial system.

The battle of the memes surfaced again in November when Griffin outbid a DAO of 17,000 investors to buy one of the few remaining copies of the US Constitution.

For nearly a year, Reddit Apes have insisted that a hedge fund short squeeze is still in the cards, in contrast to media outlets who report it will never happen.

Whatever does or doesn't happen with the short squeeze, 2021 will go down as a year the little guy figured out how to fight back against big money.

Meme stock sequel?

The Reddit Rebellion has also had a big impact on both GameStop and AMC's businesses.

At the start of last year, AMC and GME were close to bankruptcy.

The Reddit Rebellion saved both companies from Wall Street. Now, the companies are turning to the digital economy to look for a fairer fight.

There are growing signs of a productive fusion between crypto and meme stocks that could bridge the old and new financial systems, bringing the battle for market fairness onto a level playing field.

Last week, the Wall Street Journal reported that GameStop is starting a division with plans to open up an NFT marketplace. One of the hottest trends in the digital economy is play-to-earn gaming, in which gamers are rewarded with blockchain tokens.

Could GameStop accept Dogecoin for its marketplace?

AMC is busy laying plans for the meme economy, too. On Thursday, CEO Adam Aron announced his company is on track to accept Doge for movie tickets by March 2022.

This month, Robinhood is expected to roll out crypto wallets, which will allow retail to finally spend their Doge at the very companies that helped the meme economy go mainstream.

The legacy financial system snuffed out the Reddit Rebellion, just as it did Occupy Wall Street almost a decade earlier.

Rather than keeping fighting in a rigged game, protestors are voting with their wallets by opting out of the old system and into the new one.

Will Doge give the little guy the upper hand?

Doge completes the circle

Although the GME/AMC short squeeze has yet to come to fruition, the Reddit Rebellion ushered in several important changes whose consequences are only beginning to be felt.

What started as a short-term play against hedge funds evolved into a year-long social media campaign for market fairness against the financial establishment.

Slighted by legacy media and vilified by the financial establishment, meme stock movement birthed its own media ecosystem to ensure fair coverage.

2021 was the year when people organized for market fairness and almost toppled the big guy.

Pushed to the brink, the legacy system showed it won't go down without a fight.

With the people's currency in the hands of the people, will 2022 be any different?

Dogey Treats: News Bites

Melania Trump broke Twitter by wishing Bitcoin happy 13th birthday.

Starlink deployed satellites with "lasers" and now operates nearly 2,000 satellites in space.

Starlink now has 145,000 users in 25 countries.

According to Airbnb CEO Brian Chesky, crypto payments are the company's most requested feature.

Arizona Senate candidate Blake Masters raised over half a million dollars selling NFTs in order to finance his campaign.

Memes of the week

Thank You!

Thanks for reading! Consider sending a tip or Super Following on Twitter to help keep the newsletter going!

Doge: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Will Doge finish what GameStop started? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow me on twitter at @itsALLrisky

Email me at itsALLrisky@gmail.com

Send a Doge tip: DHA5831Aoh2CVhBdX8rAv74kEGzqDg9BUx

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.14 per coin.