Doge Takes On Big Crypto

Read why BlackRock is buying Bitcoin, and how Dogecoin is the people's alternative to Big Crypto

Hey everyone,

The big news in crypto is that BlackRock, the world’s largest financial asset manager, applied to launch a Bitcoin ETF.

Let’s take a look at why Big Money is finally getting into digital money, and why its entrance makes Dogecoin more important than ever.

Last week, BlackRock applied to the SEC to open a Bitcoin ETF/Trust.

BlackRock is the world’s largest money manager, with over $10 trillion in assets under its control. When the global economy was collapsing in 2020, the Federal Reserve asked BlackRock for help.

BlackRock’s Bitcoin Trust is likely to get approved. According to Bloomberg reporter Eric Balchunas, BlackRock has had 575 ETFs approved by the SEC, and only one rejected.

Blackrock’s choice to enter crypto game is a change of tune. In 2017, its CEO Larry Fink called Bitcoin “an index for money laundering.”

Fink is known for using BlackRock’s influence to impose the socially-minded ESG business framework on unwilling corporations.

In 2022, he said, "You have to force behaviors and, at BlackRock, we're forcing behaviors."

On the surface, BlackRock and Bitcoin are an awkward fit.

The SEC has denied dozens of ETFs originating from the crypto industry. Most folks probably agree that it would be better if the people who helped build the industry from the ground up were the ones offering this product to the public.

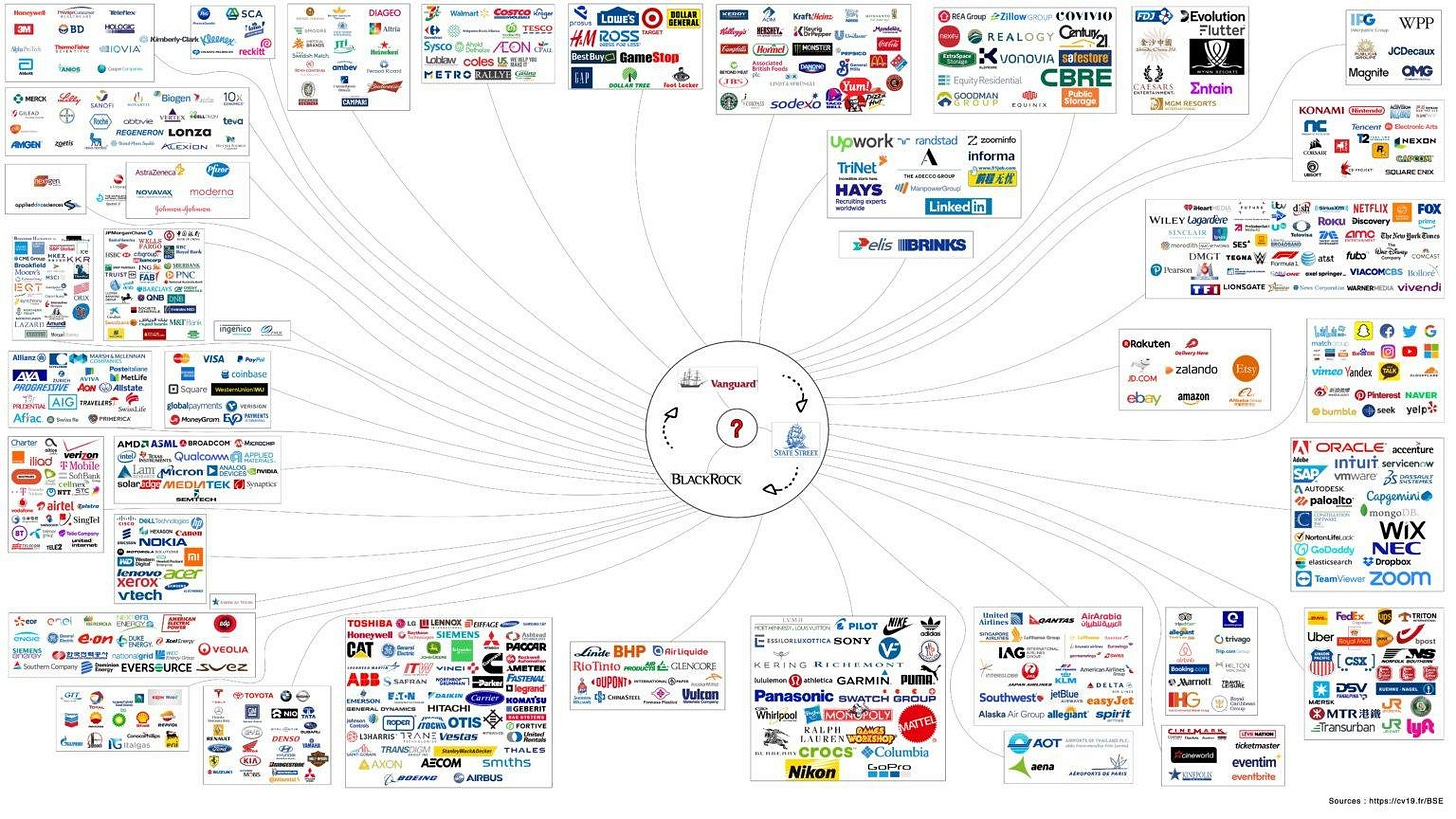

This is especially true because BlackRock is a symbol of institutional power, while the Bitcoin community prizes decentralization, sovereignty, and independence. Along with Vanguard and State Street, BlackRock possesses the biggest share of virtually every major publicly traded American company.

Though integration into the existing financial system was probably inevitable, Bitcoin has long been promoted as an alternative to Big Money, which is now bringing digital currency into the fold.

Just this morning, it was reported that Fidelity, with $4.3T under management, is expected to follow BlackRock and file for a Bitcoin ETF.

While BlackRock’s Bitcoin play marks a significant escalation of Wall Street involvement with crypto, on some level, Bitcoin has been under the sway of moneyed interests for a long time.

In 2021, Elon highlighted issues with Bitcoin’s decentralization narrative, pointing out that the mining industry was controlled by just a few large companies.

Similarly, ownership of Bitcoin is concentrated among a handful of early adopters who bought long before price reached its current levels. Over time, ownership has become more decentralized, but the big boys still run the show.

Now that Bitcoin has been adopted by the money mafia, Dogecoin has an even stronger case as a grassroots alternative to Big Crypto.

When Elon started openly supporting Doge, one of his conditions was that ownership become more decentralized so that a few large entities couldn’t easily control it.

More than Bitcoin, Dogecoin is built to resist being control by the money men.

Doge’s status as a meme makes it resistant to corporate takeover. Many companies won’t lead on Dogecoin because they worry it will make them look silly.

At this point, banks and other financial institutions would rather ignore Doge and hope it goes away than try to co-opt it, much as they did with Bitcoin over the last decade.

While Bitcoin is leading the way with corporate adoption, Doge is better fit to be the preferred coin of the creator’s economy, used to support independent journalists, artists, videographers, and other makers.

Twitter is the ideal infrastructure to make this happen. Last week, Elon’s biographer said micro-payments for individual pieces of content are coming soon.

If Doge becomes the chosen coin for creators, it has a golden opportunity to achieve a broadly distributed ownership structure among Twitter’s 250M+ users.

With BlackRock’s Bitcoin ETF, it’s getting harder to make the argument that Bitcoin is truly anti-establishment.

Dogecoin’s branding as “the people’s crypto” is more important than ever so that crypto doesn’t replicate the failures of the current monetary system.

Doge is uniquely positioned to be a force of good in the world by empowering the little guy. No other crypto or fiat currency can make the same claim.

Big Crypto is coming—don’t sleep on the underdoge!

Dogey Treats: News Bites

Through his lawyer, Elon denied claims of being a Dogecoin whale who sold coins when price was rising.

In an interview with Zuby, Elon said, “If done right, X would become maybe half the global financial system.”

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on Substack or Twitter to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

Memes of the Week

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Is Dogecoin Proof of Simulation? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on twitter at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.06 per coin.