Can Twitter Become World's Biggest Financial Institution?

Read why Dogecoin and the Bird App are solutions to banks

Hey everyone,

Last week, Elon spoke at Morgan Stanley’s Technology, Media, and Telecom conference.

At the event, he said his goal was to turn Twitter into the world’s biggest financial institution.

Sounds pretty crazy, right?

Let’s take a look at how it could happen, and why Dogecoin is his ace in the hole.

Last Tuesday, Elon gave an interview at Morgan Stanley’s TMT conference.

During the interview, Elon stated his goal to make Twitter into the world’s biggest financial institution:

I think it’s possible to create a very powerful finance experience. PayPal is like a halfway version of what I think could be done in payments and finance. You want to be able to send money easily from one account on X/Twitter to another account effortlessly with one click. You want to be able to earn interest on the money. You want to be able to have debt so your interest can go negative.

Basically, I think it’s possible to become the biggest financial institution in the world, just by providing people with convenience, payment options […] If we just make the app more and more useful, people will use it more, and it’ll be great. You’ll see.

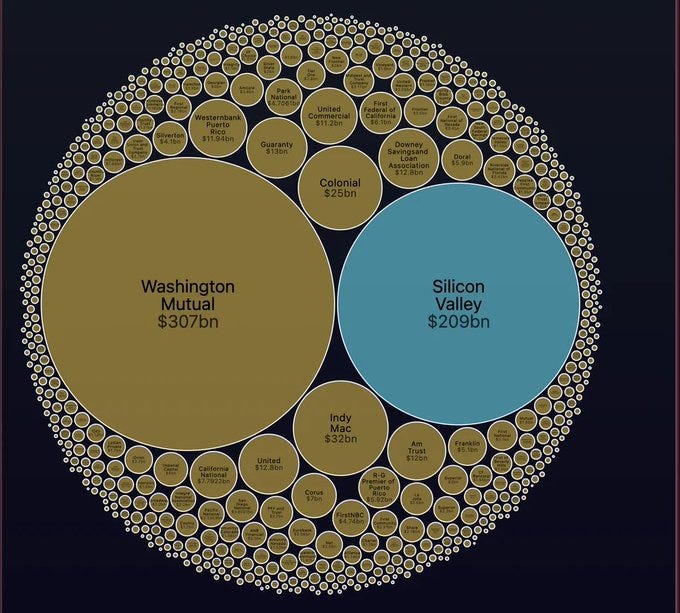

The topic of how banks work is top of mind on the Internet right now after Silicon Valley Bank collapsed on Friday, marking the second largest bank failure in modern US history.

The collapse traces back to 2021, when SVB (legally) used customer deposits to buy long-dated bonds. As interest rates have gone up, the bonds have lost value.

Word got around that SVB might not have enough cash for customers to redeem deposits. A bank run commenced, and on Friday, the FDIC took over SVB, raising the specter of systemic risk to the banking system.

SVB isn’t the only bank in trouble: crypto bank Silvergate went out of business last week, and Signature Bank was shut down on Sunday.

All three banks were friendly toward crypto companies, and their collapses were cheered on by anti-crypto politicians, adding to the sense that the government is waging an undeclared war on crypto infrastructure known as Operation Chokepoint 2.0.

Former Senator Barney Frank confirmed this interpretation when he said Signature Bank’s seizure was about sending “a very strong anti-crypto message.”

Sunday night, the Federal Reserve stepped in and announced it would backstop customer deposits for SVB and Signature, saving hundreds of companies from missing payroll.

Whether Signature and SVB will continue to exist, and in what capacity, is unknown, nor if systemic risk has been contained .

However, it’s looking increasingly like historic shifts are taking place at the intersection of technology and finance. Banks are ripe for disruption.

So will the Dogefather seize the moment and take Twitter to the top of the money game?

Here’s how it could happen in four steps!

1 Become a Bank

Twitter is already moving into the peer-to-peer digital payments business.

In November, it registered with FinCEN (the financial crimes regulator) and is reportedly working on getting state-level money transmitter licenses.

At minimum, Twitter should be able to replicate what PayPal or Venmo do, with the added benefit of being a social network that brings buyers and sellers into contact with each other.

Services like interest and debt could be trickier because the banking cartel protects its turf. Last year, the SEC threatened Coinbase with a lawsuit for offering 4% interest on dollars.

The simplest answer for Twitter might just be to become a bank, or buy one.

On Friday, after Silicon Valley Bank’s collapse, Elon said he was open to the idea of integrating it with Twitter.

Bringing SVB under Elon’s umbrella could be widely beneficial—for Twitter, SVB, and the entire tech ecosystem.

Twitter faces stiff headwinds from a financial establishment that doesn’t want to be disrupted. Buying up existing banking infrastructure might be the fastest way to realize Elon’s vision for X.com.

It also gives him the chance to build good will in the tech community by riding to the rescue during a potential ”extinction level event” for smaller tech companies.

2 Monetize Attention

During the Morgan Stanley interview, Elon ran some rough calculations about how much Twitter earns through advertising:

Twitter is the #1 news app in the world, with 500M active users, 250M daily users, and 180M significant daily users

Users collectively log 120-130 million attention hours each day; daily users spent an average of half an hour per day on the platform

Many of the smartest and most influential people in the world are on Twitter, whose attention comes at a premium

Currently Twitter makes 5-6 cents per hour of user time on platform, and no one every buys anything from Twitter ads

Until three months ago Twitter has not been trying to make ads relevant to users, but could achieve “a massive increase in revenue” by tailoring ads to users’ interests

With ads that are relevant and useful, it’s possible to get up to 25 cents an hour

If Twitter monetizes its current user base at 25 cents an hour, it could pull in $11 billion in revenue per year.

Elon has talked about getting a billion people on Twitter. Starting with the same assumptions, Twitter could earn $44B per year just on ads.

3 Build the Creator’s Economy

In the current social media ecosystem, creators are poorly rewarded for their efforts.

For now YouTube is the best platform to make a living, offering 55% of ad revenue for creators.

Twitter could poach top creators and their fans from YouTube by offering a greater percentage of revenue sharing on long-form videos.

Twitter’s other big advantage is free speech: YouTube frequently de-monetizes content it doesn’t like. Just by upholding the first amendment, Twitter has the chance to win people over.

Congress looks increasingly likely to pass a TikTok ban. If it does, Twitter could move in on the short-form video market by rebooting Vine, adding millions of Gen Z TikTok refugees to its user base in one swoop.

Another possibility is for Twitter to create infrastructure so creators can sell access to individual articles and videos through a micro-transactions paywall. If Twitter takes a small cut—between 0.1% and 1% of every transaction—it could still make a lot of money.

The mysterious Twitter Coins is the wild card. It appears to be an in-app currency for users to send tips for good content.

However it gets there, Twitter is moving in the direction of a creator’s economy. It’ll be exciting to see what the companny comes up with next!

4 Embrace Dogecoin and the Bank of Doge

Immediately after Elon told his interviewer he planned to make Twitter the biggest financial institution in the world, he clicked to a slide of his Shiba Inu Floki.

When his interviewer observed that his executive team was leaner at Twitter than Tesla, Elon said, “He Does have a black turtleneck, do you need anything more?”

Embracing crypto—and especially Doge—could be the coup de grace Twitter uses to rise to the top of global finance.

Bitcoin was created in 2009, as a direct response to the Great Financial Crisis of 2008.

It allowed for a new monetary system that ran not on the whims of private bankers and corporate interests, but on transparent, predictable computer code.

15 years later, it’s increasingly clear the legacy banking experts behind the curtain are no more in control of their Frankenstein’s monster today than they were back then.

Meanwhile, crypto adoption has marched steadily onward, despite massive resistance from the establishment.

Friday night, Elon posted a meme capturing the present conundrum: if banks can’t be counted on to keep customer deposits, are they any more reliable than cryptocurrencies?

Later, he responded positively to the suggestion that Dogecoin, which runs on similar principles as Bitcoin, could be part OF Twitter’s power play.

The need for a fair system is greater than ever, and Doge is the friendly face to onboard millions into the new financial system.

So is Twitter’s rise inevitable? How will it all go down? And is everyone’s favorite dog meme money the secret weapon?

Let’s see what happens.

Bonus Notes

The Morgan Stanley interview included most comprehensive update on Twitter yet in the months since Elon took over.

Here’s the full video along and summaries of Elon’s most notable statements:

Twitter is trying to be the most timely and accurate source of truth, even if the truth is something we don’t want to hear

Twitter is expected to be profitable by Q4

The media controls the narrative and gets to decide what goes on the front page, which has limited space; Twitter doesn’t have that limitation and allows people to decide which stories are important to them

Community notes is “pagerank for pages, as applied to people. As people build credibility in how they review notes, they build up enough credibility to actually write notes, and then those notes are rated by others, and depending on the credibility of the people rating your note, your credibility score gets effected.”

In the past, Twitter would suspend accounts on the right ten times more than on the left. In order to have a healthy national dialogue, Twitter has to represent the whole country, and has to represent everyone in other countries too—the only way to have a town square.

240 Terawatt hours of energy generated wind and solar and stored in batteries are needed for a fully sustainable energy economy,

The Materials needed to make 240 TW hours are plentiful on Earth. Earth is a “muddy rustball”, and a sustainable economy would require less resource mining than we currently use

Sustainability makes abundance possible: “you can have the things you like, in fact even more of them, and the environment can be good, all the good things are possible. We should be excited and optimistic about the future, we need to go build it, and it’s a lot of work, but you should not feel sad about the future regarding sustainable energy. It will happen, we just want to make it happen faster rather than slower”

Power Play

The banking industry is ripe for disruption, and Elon looks ready to pounce.

It’s impossible to invest in Twitter because it’s a private company.

However, if you think Elon can pull off one of the greatest coups in financial history, you can still invest in Doge!

Dogey Treats: News Bites

Coinbase called for a new financial system in a catchy advertisement.

Biden is pushing for a 30% tax on electricity used for Bitcoin and crypto mining. He also proposed raising capital gains taxes.

Is Elon building own city in Texas? He said one story from the WSJ on the topic was inaccurate.

Tesla released a video about its privacy policy for user data.

Elon tweeted that media has become a “collective NPC hivemind”

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on Twitter to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

Memes of the Week

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Will Twitter become the world’s biggest financial institution? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on twitter at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.069 per coin.