Bankman Sleeps With The Fishes: The Rise and Fall of Crypto's Greatest Fraud

Hey everyone,

Last week witnessed one one of the most sordid tales in crypto history: the demise of the exchange FTX and its founder Sam Bankman-Fried.

As fate would have it, the collapse of FTX/SBF coincided with the emergence of Twitter as an electric platform for citizen journalism.

While the lamestream media was asleep at the switch, Twitter came alive as newly verified blue checks crowd-sourced an investigation into one of the biggest financial frauds ever.

First, let’s start with the good news about Twitter, then dive down the SBF rabbit hole. At the end, we’ll take a look at why Dogecoin is crypto’s only hope.

The Blue Comet

Twitter is looking strong!

Last week, Elon revealed that active users and user growth hit all-time highs.

He tweeted out a graph showing the number of Daily Active Users going parabolic since his acquisition.

While Twitter takes flight, the legacy media has been churning out endless stories about its downfall, but the numbers don't lie.

Part of the reason for the success is that the platform is evolving at a breakneck pace.

Blue-check verification for all rolled out last Wednesday, less than two weeks after Elon stormed into HQ with sink in hand.

So far, verification is working as intended. The spam bots that made Twitter unusable are nowhere to be found.

Verification is just the first step in a multi-stage plan to reinvent the platform. Big happenings are afoot.

On Wednesday, several outlets reported that Twitter had filed paperwork with the US Treasury to become a payments processor.

A license would allow Twitter to transfer money, exchange currency, and cash checks. It also requires the company to report suspicious transactions.

One report claimed that Twitter's payments product would accept crypto, including Dogecoin.

Another said that Twitter is working to offer a "high-yield money market account" that will turn it into "the people's financial institution."

Elon isn't going to settle for merely replicating PayPal or Venmo. In a recent interview with investor Ron Baron, he laid out his full vision for Twitter to become "the most valuable finance institution in the world."

Twitter's success would be catastrophic for legacy institutions—especially banks and the media—which have gone to war on Elon to scare the public away from the platform.

Twitter clearly has superior technology, but victory isn't guaranteed. On Thursday, a leaked email from Elon to Twitter's staff read, "Without significant subscription revenue, there is a good chance Twitter will not survive the upcoming economic downturn."

He also explained his recent sale of $4 billion in Tesla stock as a measure to save Twitter. How he's going to use the money remains a mystery for now.

Big headwinds are coming from dark money activist groups pressuring advertisers to drop the platform by associating it with hate speech. Despite their fear-mongering, it's not clear anything about Twitter's content moderation has actually changed.

Legacy media has also produced a steady stream of negative content about Twitter. Most of the the critiques have a hysterical quality and don't reflect the electric feeling on the platform right now.

Ironically, the hit pieces have given the platform free publicity and are one of the factors driving user growth.

Elon attributed the media's salty take to turf protectionism, writing, "As Twitter pursues the goal of elevating citizen journalism, media elite will try everything to stop that from happening."

Twitter's success or failure will depend on how it balances Elon's two big goals: restore free speech to the Internet, and build a cutting-edge financial institution.

If he succeeds, nothing will be the same. If not, we'll still be given a glimpse of what life could be like outside the legacy control system.

This is one of the most interesting developments in the history of the Internet. Don't look away. 👀

For All Debts Public and Private

These financial and informational vectors converged last week during first big story of the new Twitter: the stunning collapse of crypto exchange FTX.

FTX was the world's second-largest crypto exchange. Based in the Bahamas, it was run by political mega-donor Sam Bankman-Fried, known in the industry as SBF.

Similar the Luna debacle earlier this year, FTX's collapse originated with its unbacked "exchange token" FTT.

FTX encouraged people to use FTT instead of dollars to trade other cryptocurrencies like BTC and Doge by offering discounts on trading fees.

FTT was highly centralized, allowing a few entities to arbitrarily set the price for the most part free of market influences, similar to plastic chips at a casino, which are intrinsically worthless except for the fact that the casino swaps them for real money.

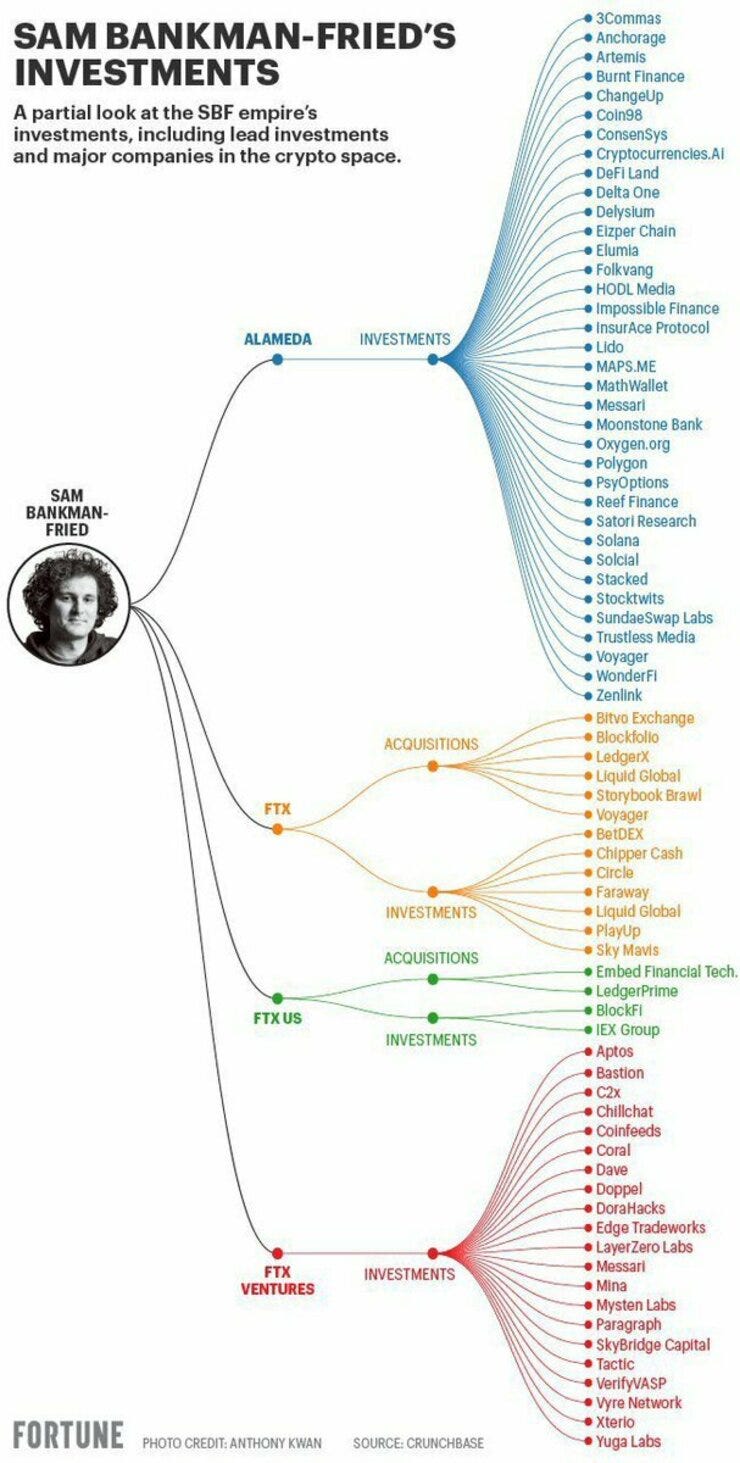

One of the largest holders of FTT was Alameda Research, also founded by SBF, which owned at least $3.66 billion worth of the token. Alameda functioned as the trading arm of SBF's empire and was more or less a crypto hedge fund.

The relationship between FTX and Alameda was shady. There's no good reason for an exchange to have its own trading shop unless it's looking to profit off user data. The blurred lines between the two companies was always suspicious and led to last week's trouble.

After this summer's Luna collapse, which wiped out billions from the crypto market, FTX reportedly loaned Alameda $10 billion in customer assets, including lots of FTT, to help cover losses. It did so without informing customers and in breach of its own terms of service.

Alameda managed to lose those funds, taking out loans from other institutions that were collateralized with the borrowed FTT.

When Coindesk published a report on Alameda's precarious balance sheet at the beginning of November, it became clear that Alameda had overborrowed (they had $7.4 billion worth of loans).

Even a small amount of FTT selling from anyone was certain to drive the token's price down, creating a doom loop in which Alameda had to liquidate its borrowed FTT to pay back creditors, which in turn would drive the price of FTT even lower and force more liquidation ad infinitum.

As it happened, FTX's rival and the world's largest exchange, Binance, owned over half a billion dollars worth of FTT, stemming from an investment Binance made in FTX in 2019.

On Sunday, in the wake of the Coindesk report and a brief feud with SBF, Binance CEO CZ announced he was liquidating Binance's FTT holdings to protect his business.

The announcement, which amounted to a vote of no confidence in FTX from one of the most respected business leaders in crypto, sent shockwaves through the industry, cratering the price of FTT and setting into motion the collapse of Alameda and FTX.

As rumors of FTX's potential insolvency swirled, customers withdrew $6 billion worth of assets from the exchange, further damaging its financial position. The bank run was on, and FTX froze customer withdrawals when it became obvious they didn't have the assets to fulfill them.

Tuesday, CZ completed the coup when he announced Binance had entered into a non-binding agreement to acquire FTX.

As FTT plummeted, news leaked that Binance was in a position to acquire FTX for $1, or even 1 Doge.

On Wednesday, after looking at FTX's books, Binance walked away from the the deal, tweeting, "The issues are beyond our control or ability to help."

$10 billion worth of client funds are still missing from FTX. Multicoin Capital and Sequoia have acknowledged being hurt by the loss of funds. There are doubtless others.

FTX is facing investigations from the DOJ, CFTC, and SEC for misuse of customer funds.

Reportedly, SBF is "under supervision" by local authorities in the Bahamas, while other top executives have explored fleeing to Dubai. Jail time for FTX employees seems likely if the authorities do their jobs.

SBF's warp-speed narrative arc from nobody to hero to villain is the kind of thing you only see in crypto.

In 2017, he founded Alameda, a quantitative trading firm that made $20 million arbitraging Bitcoin by buying it in the US and selling at a premium in Japan.

He started FTX in 2019 and quickly rose to prominence as a young leader of the US crypto industry.

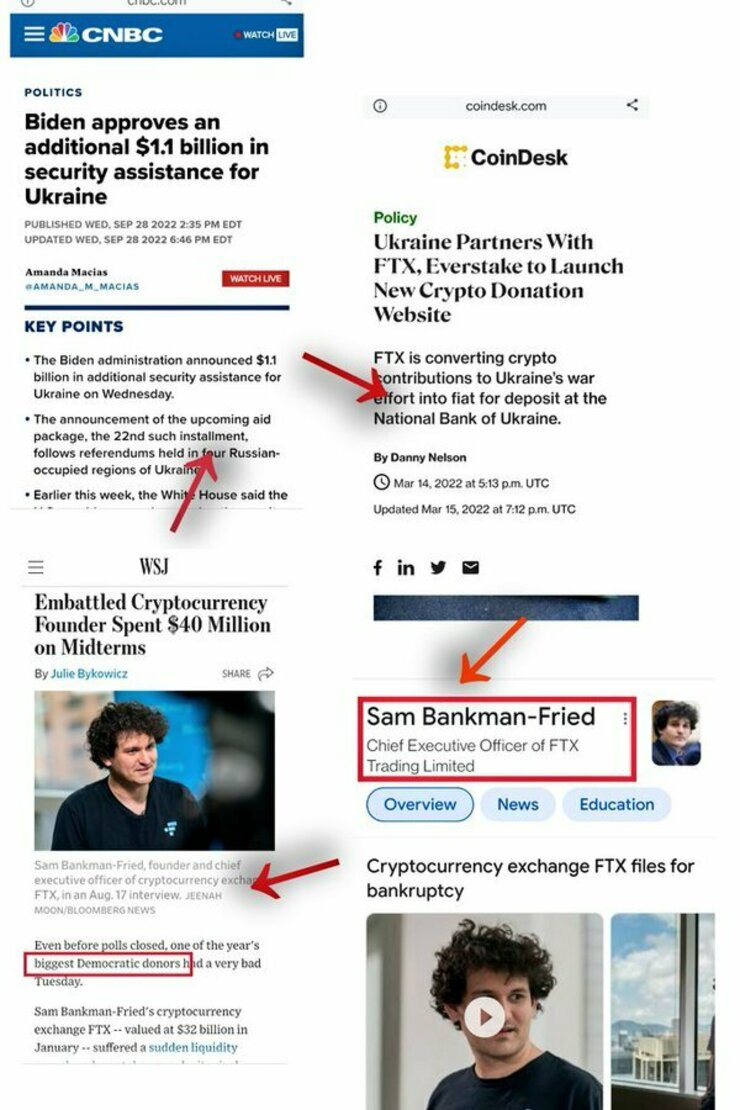

In 2020, he was the second-largest donor to Joe Biden's campaign. He testified before Congress twice to ask for federal regulation of crypto.

He also publicly courted prominent Democratic politicians, including Maxine Waters, Chair of the House Financial Services Committee, and Bill Clinton.

As his empire grew, FTX expanded its presence into the mainstream in a bid to become the public face of crypto in the US.

It bought the naming rights to the Miami Heat's stadium, inked Tom Brady and Steph Curry to endorsement deals, and ran a Super Bowl ad featuring Larry David.

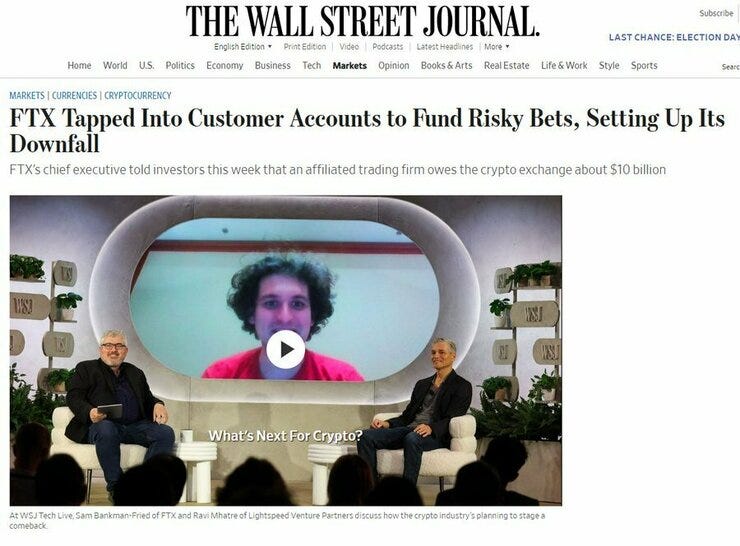

In contrast to most crypto savants, legacy media fawned over SBF, giving him the standard "boy genius" treatment.

In February of this year, Politico ran an article about him titled, "Crypto's aspiring Washington kingmaker."

A few months later, Bloomberg called him "a kind of crypto Robin Hood" for his pledge to give away 99% of his wealth in the name of Effective Altruism. His philanthropy included climate change, Covid preparedness, and veganism.

Fortune asked if he was "The Next Warren Buffet." He was even being profiled by Michael Lewis for a book.

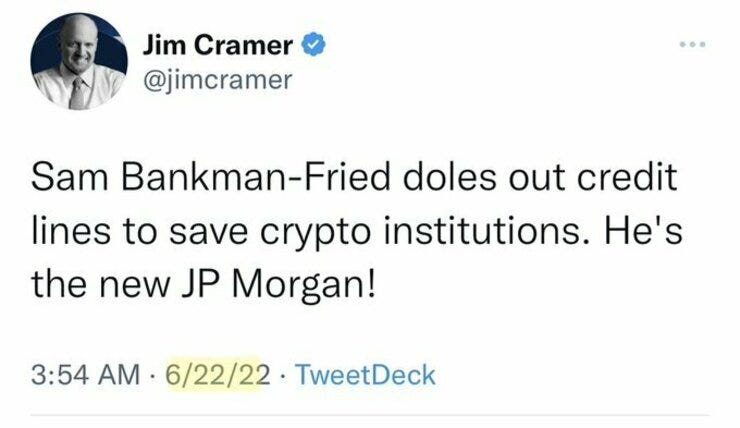

He burnished his good-guy image in the wake of the Luna situation when FTX invested in distressed companies Voyager and BlockFi, acting as an industry backstop at a moment when it was reeling. Jim Cramer compared him to JP Morgan.

In the last few months, however, SBF's star began to fade.

His support for a crypto regulatory bill drew sharp criticism from Decentralized Finance supporters because the it required coders to build regulatory compliance into the protocols themselves. Folks worried the bill would kill the anonymity of DeFi.

In a viral debate with crypto OG Eric Voorhees, SBF struggled to explain why the government should regulate the kind of software people can write, leading to a swell of SBF-distrust.

For a lot of folks who put SBF under the microscope, his story just didn't add up.

All that was bad enough, but it pales compared to the optics of losing $10 billion worth of other people's money.

This is especially true for such a politically connected figure. SBF was the second-largest Democrat donor for the recent midterm elections, behind only George Soros.

His political connections go deeper: his mom founded a Super PAC called Mind the Gap to funnel money from Silicon Valley to the Democratic Party.

His dad is a Stanford Professor in tax law with expertise in tax shelters and a history of lobbying Congress on behalf of hedge funds.

His brother founded a non-profit called Guarding Against Pandemics aimed at empowering the expert class to "prevent future pandemics." The organization lobbied for a $30 billion federal plan to mitigate the risk of the next pandemic.

Various FTX employees have connections to the World Economic Forum, Clinton Foundation, Obama administration, and Democratic Party.

The fact that FTX collapsed on election day is the most ironic outcome imaginable, and feels like some sort of omen.

As recently as last week, FTX was valued $32B and SBF worth $14.6B. Today, he is bankrupt, owing $650M to lenders.

Few media outlets are asking the hard questions, or even paying much attention.

The void has been filled by citizen journalists on Twitter, who've done a fair bit of speculating about what's really going on.

Some of the theories are intriguing:

The FTX blowup was engineered to pave the way for onerous federal regulation and/or a CBDC

FTX was a tool for Wall Street to manipulate crypto

SBF was in some way behind the Luna collapse

SBF is secretly Chef Nomi, the pseudonymous creator of the Sushi token, which collapsed in similar fashion (but on a much smaller scale) before SBF very publicly rescued it during the DeFi Summer of 2020

FTX was behind a recent hack that drained $580M from Binance's BNB coin, and CZ's coup de grâce was retribution for the hack

FTX amounted to a corporate cult involving amphetamine use and orgies

FTX funded the TOGETHER trial, a controversial trial cited by the NIH to show that Ivermectin was ineffective against Covid-19

"SBF" is a deep state alias/plant/spook with a fabricated identity

SBF is just the fall guy; the real mastermind was FTX's "legal counsel" Dan Friedberg, whose presence has since been scrubbed from the Internet

SBF is some combination of Bernie Madoff and Jeffrey Epstein

All these possibilities merit investigation, but obscure a more pressing journalistic mandate: follow the money.

Where did the money go? If FTX lost $10 billion in client funds, who won? The money didn't just disappear—someone took the other end of Alameda's losing trades. Who?

What about the relationship between FTX and Ukraine, who partnered back in March to allow Ukraine to convert crypto donations into fiat.

Ukraine is famously corrupt—could US tax dollars sent to Ukraine have found their way back into US politics by way of FTX?

Another thread worth tugging on is the story of Caroline Ellison, CEO of Alameda, tapped by SBF to run the hedge fund even though she "just didn't really know what to do" with her life after college.

Is it weird that her father was SEC Chair Gary Gensler's old boss at MIT? Or that, according to Congressman Tom Emmer, Gensler was working with SBF to create a regulatory monopoly for FTX?

Is it weird that SBF funded campaigns of congresspeople who were in charge of picking the head of the Commodity Futures Trading Commission (CFTC)? Or that SBF lobbied to have the CFTC become the leading agency to regulate crypto?

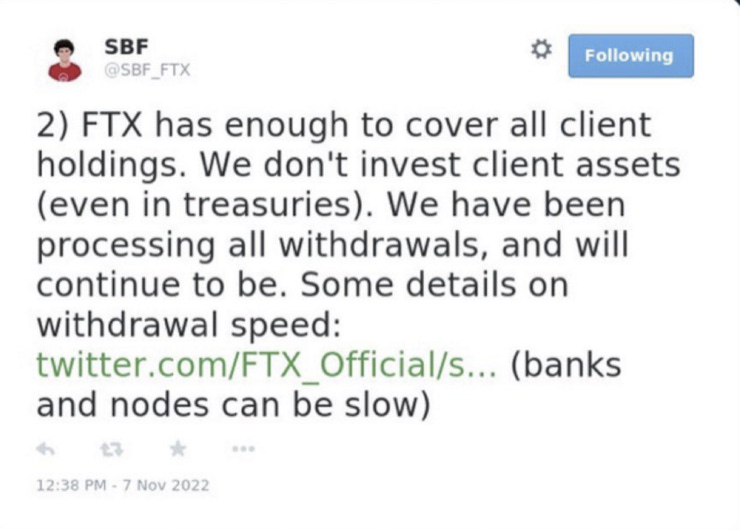

Then there is the disturbing pattern of dishonesty in the way SBF communicated with the public.

In the weeks leading up to the collapse, SBF repeatedly tweeted photos of his FTT buy orders, implying that he thought it was a good investment even as he was uniquely positioned to know how terrible an investment it was.

The day before FTX fell apart, he tweeted that all customer funds were safe, writing, "We don't invest client assets" (he later deleted the tweet).

Last Thursday, with FTX in free-fall, he tweeted that FTX US, a separate company, "was not financially impacted by this shitshow."

One day later, FTX US filed for Chapter 11.

This level of fabrication suggests that SBF was acting not out of the aw-shucks incompetence criminals like to feign when they've been caught, but something closer to evil.

$10 billion is a huge sum of money. Many folks lost their life savings trusting an institution given the seal of approval by crypto's top influencers. A teacher's pension fund took a $95M L.

Can there be any doubt that the wealth ended up in the bank accounts of some white-collar gangsters?

Until proven otherwise, it should be assumed that the collapse of FTX represented yet another intentional transfer of wealth to the upper echelon of financial and political elites.

Before politicians foist any pre-packaged solutions on us in the form of crypto regulation, we deserve a transparent investigation into the parties that benefited from these events, and their relationship to the political process.

Unfortunately, the regulatory agencies, captured as they are by the banks, are probably the last people that can be trusted to carry this out.

If this tale wasn't already unbelievable enough, SBF's arc has several intersections with Dogecoin.

As FTX rose to prominence, SBF aggressively courted favor with The Dogefather.

In 2020, SBF tweeted at Elon to ask him about getting an allocation of SpaceX stock, offering to donate money to the Dogecoin Foundation in return.

This year, he conspicuously displayed a Picasso-like painting of a Doge in his office.

When Elon was working to acquire Twitter, SBF twice made overtures to provide funding for the deal.

He also offered to help build a blockchain version of Twitter that ran on Dogecoin.

The Dogefather, however, wasn't interested.

In one text message, he presciently asked, "Does Sam actually have $3B liquid?" He later explained that SBF "set off my bs detector."

In the end, he accepted $500M from CZ and Binance instead.

It isn't entirely surprising Elon rejected SBF.

FTX is a partner of the World Economic Forum, which favors global governance by economic elites and whose Bond-villainish founder Klaus Schwab famously bragged of infiltrating government cabinets to shape the world.

In contrast, Elon has often spoken in favor of direct democracy, First Amendment rights, individual sovereignty, and freedom from government interference.

Philosophically, the two couldn't be more opposed.

Finally, FTX played a pivotal role in Dogecoin's 2021 crash.

Hours before Elon's SNL appearance last year, Wall Street pooh-bah Barry Silbert used FTX's DOGEBEAR 3X leveraged token to short Dogecoin, and encouraged others to do the same.

Revelations of FTX's insolvency followed close on the heels of Doge's recent 100% breakout. Did Alameda get rekt shorting Dogecoin?

Whatever the cause, we've come full circle from the events of April 2021. SBF may have curried favor with the Dogefather, but his actions run contrary to everything Dogecoin stands for.

The message of his demise couldn't be clearer for the Capos, Underbosses, and aspiring Dons of the crypto world: don't mess with Doge!

A Hit Is a Hit

The overlap between FTX's demise and Twitter's emergence as a hub of citizen journalism was perfectly timed.

Legacy media has for the most part downplayed the magnitude of the events (can you imagine if SBF was a Trump donor?) while the story has dominated the Internet news cycle.

FTX is the first big test to see if Twitter can bypass mainstream control of the official narrative and become the world's most accurate source of information.

As events unfolded throughout the week, the hive-mind got to work figuring out was really going on. It was exhilerating to watch a white collar crime being documented in real time.

On Friday, FTX released a statement on Telegram claiming to have been hacked and advising people to stay away from its website.

Observers monitored public blockchains as funds began to disappear from FTX's wallets, while noting that the story was a convenient way around FTX's bankruptcy freeze. Others picked up on suspicious activity on FTX's NFT market.

A community of citizen journalists led by Mario Nawfal hosted several hourslong Twitter Spaces, which functioned like journalistic town hall meetings.

They were able to track SBF's location, report on police activity at FTX headquarters, trace responsibility for Luna to SBF, and interview several whistleblowers, including an insider who confirmed that SBF created a backdoor for withdrawing customer funds without detection.

The group is still on the case. Their investigation represents the efforts of hundreds of thousands of unconnected individuals to crowdsource reporting on a bombshell story to which the mainstream seems curiously oblivious.

Elon attended one of the events and later called the effort "Twitter at its best!"

During the Spaces discussion, Elon was asked about the future of crypto in light of the collapse.

He began his remarks with the optimistic rallying cry, "Doge to the moon!" causing pandemonium among the other speakers.

With 370k people listening across the world, he gave his strongest endorsements for Dogecoin yet: "I'm working hard on the Doge front [...] I think there's probably a future for Bitcoin, Ethereum, and Doge [...] If you've got one of those three in a cold wallet, not on an exchange, my guess is, it works out well."

Listen to his full comments here:

Crypto has never needed Dogecoin more than it does now.

Throughout all these events, there's been a sense of darker, slipperier forces operating beneath the surface. No one knows how deep this story goes.

With the industry in crisis and widespread belief that FTX will drag other institutions down with it, people are looking for a ray of light.

At the same time, the new Twitter holds the possibility of a future brighter than anyone imagined: a creator's economy that runs on decentralized digital cash.

Folks keep waiting for institutions, corporations, and governments to come to the rescue, but maybe it's the people themselves that save crypto by uniting behind Doge.

The promise of "the people's crypto" has always been to bring us together through the forces of love and humor.

Is Dogecoin the light at the end of the tunnel?

Mergers and Acquisitions

The world of crypto operates on mafia principles, complete with plots, coups, and turf wars to rival the final season of The Sopranos.

When Elon dubbed himself The Dogefather, it was more than just a cool-sounding nickname. He was taking the apex position in a network of independent, loosely affiliated actors all seeking to maximize their respective self-interests and avoid becoming collateral damage of cutthroat digital asset markets.

For the most part, Dogefather has remained in the backdrop over the last year and a half, biding his time while various mid-tier crypto dons cannibalized each other.

SBF is the biggest domino to fall so far, and his demise is an object lesson in how unforgiving the world of digital finance can be.

Contagion from FTX's collapse is likely to drag down other power players, and it's anyone's guess how many other big names are swimming naked as the tide goes out.

Like with the mafia, the fall of one boss creates a power vacuum for others to fill. With the industry melting down, Elon is stepping forward with wildly ambitious plan to build "the most valuable financial institution in the world."

For now, The Dogefather is allied with the world's largest exchange. He oversees the biggest crypto media ecosystem. And he is transforming Twitter into a payments network to rival the legacy financial system.

Game Over for SBF, and Go Time for Doge.

Dogey Treats: News Bites

Elon wrote a letter to twitter employees, saying that blue-check verifications subscription revenue would help Twitter survive "the upcoming economic downturn." He announced he's be working and sleeping at Twitter HQ "until org is fixed."

Twitter's head of Trust and Safety Yoel Roth resigned. Twitter eliminated 4,400 of its 5,500 contract employees.

Elon

Elon posted memes about pigeon messengers and resistors. He trolled Paul Krugman for opening a Mastadon account and suggesting it as an alternative to Twitter. Krugman warned of a "Muskocalypse"--"a mass influx of crazy people." A few minutes later, Elon tweeted, "What do you call someone who is a master at baiting?"

Joe Biden said "Elon Musk's cooperation and/or technical relationships with other countries is worthy of being looked at" in reference to the Twitter deal. Elon drew attention to a connection between the Biden administration and TikTok.

The day before the midterms, Elon said that "independent-minded voters" should vote Republican in the mid-term elections to curb the excesses of one-sided power. He added, "Hardcore Democrats or Republicans never vote for the other side, so independent voters are the ones who actually decide who’s in charge!"

Global Financial System

President Xi of China is expected to visit Saudi Arabia before the end of this year. Saudi Arabia is considering joining the BRICS coalition.

British financier Sir Evelyn de Rothschild, head of the eponymous London banking dynasty, died at 91.

Meta laid off 11,000 employees.

Ukraine-Russia

The day after US midterm elections, Ukraine signalled openness to peace talks.

Dogecoin

Elon tweeted, "BTC will make it, but might be a long winter." He liked two tweets with Dogecoin memes, including one that predicted Doge payments on Twitter in 2023. When a Doge community member drew attention to influencer Matt Wallace's promotion of scamcoins, Elon responded "That is not good."

Jim Cramer advised people to cash out of crypto, including Dogecoin.

BronzeTheDoge raised 400,000 Dogecoins and is a few thousand dollars away from its goal. The fundraiser is still ongoing.

Crypto

Crypto millionaire Nikolai Mushegian tweeted, "CIA and Mossad and pedo elite are running some kind of sex trafficking entrapment blackmail ring out of Puerto Rico and caribbean islands. They are going to frame me with a laptop planted by my ex gf who was a spy. They will torture me to death." Hours later, he was found dead.

Senators are reportedly moving forward with SBF's crypto regulation bill. Elizabeth Warren and Coinbase CEO Brian Armstrong disagreed over the right path for crypto regulation. BlockFi paused client withdrawals and is likely a casualty of the FTX collapse. The World Economic Forum deleted their FTX partnership page.

The DOJ seized over $3 billion worth of Bitcoin connected to the Silk Road. Edward Snowden tweeted that he's "starting to feel the itch to scale back in" to Bitcoin.

Fox Business reported that settlement in the SEC vs. Ripple case is expected on Tuesday. Ripple denied the news.

Meme Stonks

Redditors presented evidence that FTX tokenized stocks were involved in synthetic short-selling of meme stocks.

Tesla/SpaceX

Tesla released a video about its Megafactory, a new Megapack battery factory in Lathrop, California. Tesla published job postings for the Cybertruck.

SpaceX bought a small advertising package on Twitter to test the effectiveness of its advertising.

Free speech

Several people spoke up in support of Kyrie Irving after the Brooklyn Nets gave him a long list of conditions for returning the team. Jay Williams and Nick Cannon referred to the slave-era practice of 'buck-breaking' in which rebellious slaves were subject to ritual humiliation to serve as an example for others. Shannon Sharpe, Candace Owens, Louis Farrakhan, Jaylen Brown, and even LeBron James questioned the level of punishment.

Ye told an interviewer, "they can’t control me…I’ve never killed anyone so I can say whatever I want & not go to jail." In the same interview, he said his mother was sacrificed. Isaiah Jackson, author of "Bitcoin and Black America," was dropped from CoinDesk after tweeting "Kanye was right." On SNL, Dave Chappelle roasted Ye for violating the unspoken rules of show business.

UFOs

The DOJ reportedly raided the house of the owner of a popular UFO website about Area 51.

Thank You!

Thanks for reading! Consider sending a tip or Super Following on Twitter to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

Memes of the Week

It's ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on twitter if you enjoyed this article.

What do you think? Will Dogecoin save crypto? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on twitter at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.08 per coin.