A Bitcoin ETF Is Coming—What Does It Mean for Doge?

THIS Is Why We Might Not See a Dogecoin ETF Anytime Soon

Hey everyone,

The talk of crypto-land is the imminent approval of a Bitcoin Exchange Traded Fund, or ETF.

ETF approval would be a massive step forward for cryptocurrency, signaling acceptance of digital assets by Wall Street like never before. But its not without its drawbacks

Let’s look at how a Bitcoin ETF could shift the landscape for crypto, and why a Doge ETF probably won’t follow in its tracks.

Thanks for reading Risky Reads: The People’s News for the People’s Coin—𝕏’s leading open-source newspaper.

If you enjoy this newsletter, consider subscribing for bonus content on 𝕏. Subscribers receive exclusive commentary on crypto, AI, and the online memescape. Sign up via my profile today!

The crypto world is abuzz over the expected approval of a spot Bitcoin Exchange Traded Fund, or ETF.

Though it’s not a done deal yet, a flurry of news in recent weeks has created the sense that ETF approval has never been closer.

An ETF that holds actual Bitcoin would potentially allow billions of Wall Street dollars to enter the digital economy.

A spot Bitcoin ETF is an investment product that allows investors to gain exposure to Bitcoin without actually holding it.

Investment banks like BlackRock will buy Bitcoin, and then sell shares representing their holdings to individual investors and other firms. The shares will directly track the price of Bitcoin.

ETFs offer a few important benefits for investors. Most importantly, like with a gold ETF, custody is handled by the investment banks, meaning people can invest in Bitcoin without having to worry about keeping it safe themselves.

For this reason, ETFs are attractive to retirees, mutual funds, and others who recognize digital assets as an exciting investment opportunity, but don’t want to worry about setting up a Coinbase account or keeping track of a seed phrase.

A Bitcoin ETF potentially broadens the range of Bitcoin investors by millions of people, including the most crypto-averse generation, the Baby Boomers. Consequently, there has long been anticipation that ETF approval would send Bitcoin’s price to the moon as a tidal wave of institutional capital floods in to compete for limited supply of available coins.

Prior to 2023, the Securities Exchange Commission denied all Bitcoin ETF applications.

It did so while providing minimal feedback to applicants, essentially sending the message that it had no plans to change its mind.

The first sign that something was different came last June when BlackRock, the world’s largest financial firm, filed paperwork to launch a Bitcoin ETF.

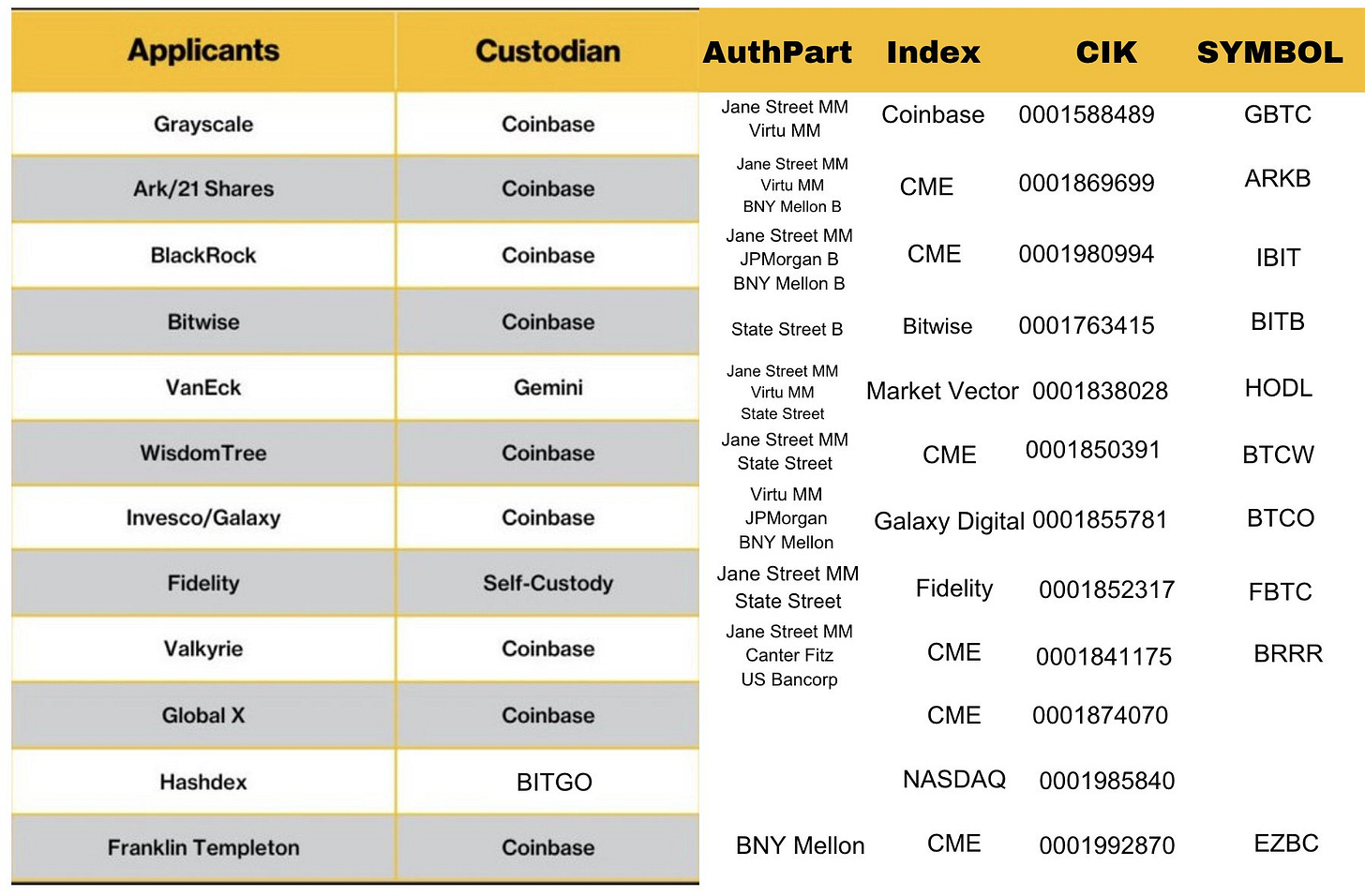

BlackRock has applied to launch 496 ETFs, and had 495 of them approved. Shortly after BlackRock made its move, several other funds followed with applications.

Over the ensuing months, the SEC held regular meetings with asset managers to provide feedback on their applications.

In December, reports of the meetings and revised applications became a daily occurrence. The sudden flurry of action in the application process is the best evidence that ETF approval is imminent.

Last week, Bloomberg reported that Friday, December 29th, was the SEC’s deadline to file ETF paperwork for the first round of approvals.

Nine asset managers submitted final applications to launch ETFs at the beginning of 2024. The widely reported launch date for the ETFs is between January 8th and 10th.

On Saturday, Reuters reported that funds could be notified about their applications’ status as early as tomorrow or Wednesday. Several have already begun to run commercials for ETFs.

An ETF approval would be a historic moment for crypto for a couple reasons.

Traditional Finance (TradFi) has done its best to downplay blockchain technology. Even as Bitcoin became one of the best-performing financial assets of all time, legacy banks and funds either pretended it didn’t exist or cast shade on it. Legacy media generally followed the TradFi narrative.

As recently as early December of 2023, JPMorgan Chase CEO Jamie Dimon testified to congress that crypto was for “criminals” and said “if I were the government I'd close it down.”

Now, ironically, Dimon’s bank has been named an “authorized participant” in Bitcoin ETFs by BlackRock and Valkyrie.

Dimon’s flip-flop in the span of a few weeks was cited as a classic example of “watch what they do, not what they say.”

Whatever happens with Bitcoin’s price, ETF approval is a symbolic step forward for cryptocurrency, which has finally gained recognition as a legitimate financial asset by TradFi.

In recent weeks, as ETF approval has come to seem increasingly likely, debate ensued among prominent Bitcoiners about its probable impact:

Nic Carter predicted a "muted" effect on price when ETFs launch because approval is already priced in, while holding a more positive mid-term outlook

Pomp predicted a big marketing blitz, urged ETF issuers to cater to Bitcoiners, and cited interest rate cuts and other macro factors to argue that "the next 24 months should be fun" for digital commodities

Max Keiser said that ETFs would put large quantities of Bitcoin in the hands of Wall Street, which would use that liquidity to manipulate the market further

Perhaps the most interesting perspective on ETFs came from crypto OG Arthur Hayes, founder of the BitMex exchange.

Hayes warned that if ETFs become too succesful, they will destroy Bitcoin as a transactional currency.

The reason for this is banks could gobble up millions of Bitcoins, which would then sit inertly in investment vehicles.

Bitcoin’s value derives from its velocity: every time a Bitcoin moves, miners expend electricity to validate the transaction, and are rewarded with a transaction fee.

If Bitcoin stops circulating, miners will stop collecting fees. Over time, fewer fees would make mining less profitable, until miners are forced to shut down. The fewer miners in operation, the less secure the blockchain would become.

In this way, Bitcoin’s acceptance by Wall Street could be the beginning of its slow slide into obsolesce as a form of money, roughly following gold’s historical trajectory from a widely-used transactional currency to an investment with limited real-world utility.

Hayes’s thesis is a hypothetical thought experiment, and a very forward looking one at that.

The scenario he describes plays out around 2140, after the last new Bitcoin is mined and miners must rely solely on transaction fees to remain profitable. Therefore, it’s not something to worry about tomorrow.

However, his argument points to a key difference between Bitcoin and Dogecoin.

Doge’s status as a meme means that prestigious financial institutions probably won’t embrace it anytime soon. Those expecting a Dogecoin ETF to follow on Bitcoin’s heels shouldn’t get their hopes up.

For Doge to rise, it will have to succeed as a grassroots form of money, adopted by regular humor-loving folk for everyday purchases.

The deep-pocketed money managers of Wall Street, whatever their virtues, are not known for their sense of irony. Dogecoin is unlikely to suffer the fate described by Hayes, in which all circulating coins get vacuumed up by banks and dumped into static investment vehicles.

On the contrary, Dogecoin’s issuance schedule, low transactional fees, and broad humorous appeal make it ideally suited to be used a form of cash. More than Bitcoin, Doge is built to move, and that movement is its lifeline.

A Bitcoin ETF would be a huge step forward for cryptocurrency, signaling acceptance from most prestigious financial institutions in the world.

But progress doesn’t come without drawbacks: the advent of Bitcoin ETFs probably won’t improve Bitcoin’s standing as a form of digital money traded for goods and services. It might even hurt it.

If Bitcoin changes from a transactional currency to an inert investment, there will be a gaping hole in the world for a decentralized digital currency. Dogecoin is the leading contender to fill that void.

If Bitcoin is for the suits, Doge is for the people. We probably won’t see a Dogecoin ETF anytime soon, and that’s probably a good thing.

What do you think: Does a Bitcoin ETF signify progress for crypto? Would you like to see a Dogecoin ETF follow?

Dogey Treats: News Bites

Elon reposted his Doge-themed NFT, asking, “whatever happened to… [NFTs]”

Doge Desiner posted that 2024 would be the Year of 𝕏 Payments. Elon responded, “True.”

Elon reiterated his argument that a positive AI future would lead to an age of abundance and questioned how humans would “find meaning in a world where work is optional,”

Memes of the week

Thank You!

Thanks for reading! Consider sending a tip or Subscribing on 𝕏 to help keep the newsletter going!

DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

It’s ALL Risky!

Thank you, kind reader, for reading and subscribing to this newsletter. I really appreciate it!

If you haven’t already, please sign up to this email newsletter for more weekly articles like this one. Also, please share it with a friend or on 𝕏 if you enjoyed this article.

What do you think? When will the Dogefather strike? Let me know!

Remember, Dogecoin is risky. But then again, it’s all risky!

Follow on 𝕏 at @itsALLrisky

Send an email to itsALLrisky@gmail.com

Send a Doge tip: DJ2zTEdHBD3guHLfVaNBaypr6bHFG5Nwfw

This article was written in collaboration with @CryptoDogDivine, give them a follow!

Don't forget to subscribe to this newsletter!

Disclaimer: This is not financial advice and I am not a financial advisor. The article above references an opinion for entertainment purposes only and it is not investment advice. Always assume that the author of the article is actively trading and that the opinions expressed may be biased towards the author’s holdings. Do your own research and consult with a licensed financial adviser before making any investment decision. Do not treat any opinion expressed in this newsletter as a specific inducement to make a particular investment. Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or cryptocurrency or to engage in any particular investment strategy. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, cryptocurrency, or financial product does not guarantee future results or returns. Dogecoin is a speculative and highly volatile asset susceptible to pump-and-dump schemes.

At the time of publication, Dogecoin is around $0.09 per coin.